Investing in the stock market can be a lucrative way to grow your wealth over the long term, but it can also be confusing and intimidating for those who are new to the game. In this article, we will provide a comprehensive guide to understanding stock market investing, including the basics of stocks, how to choose stocks to invest in, and strategies for managing your portfolio.

Read MoreThe recent news regarding interest rate hikes and the collapse of major banks may seem concerning to some investors. It is important however, to keep in mind that short-term fluctuations in the market do not necessarily reflect the long-term growth and productivity of the economy. In fact, long-term investing has historically provided favourable returns and has several benefits that can help you achieve your financial goals.

Read MoreEven though Fringe Benefits Tax (FBT) is designed to capture benefits enjoyed by an employee, it is levied on the employer. Unless your employment agreement allows for any FBT that becomes payable to be recouped from the employee, the employer will have no recourse for reimbursement.

So, why should an employer lodge an FBT return where no FBT is payable? Well, for the simple reason that it turns on a three-year deadline for the ATO to commence audit activities.

Read MoreRunning a business without clear intent is like trying to drive blindfolded. You may make some progress, but you're more likely to end up off track and off course. This is why it's crucial to have a clear purpose and direction for your business. Benjamin Franklin once said, " By failing to prepare, you are preparing to fail". When you run a business with intent, you have a far better chance of achieving success. Here are five benefits of running a business with intent:

Read MoreTo minimise your tax liability, maximise your after-tax position, and boost your cash flow, it is best to start year-end tax planning well before June 30 and make it ongoing. This year is also particularly important as the Stage 3 tax cut will come into effect on 1 July 2024.

Read MoreThe Australian Taxation Office (ATO) has refreshed the way that taxpayers claim deductions for costs incurred when working from home. The changes better reflect contemporary working-from-home arrangements.

Read MoreIt's a good time for older people in Australia to keep working and many older Australians also want to work longer before retiring. However, most older Australians are not preparing for the end of their working years. Studies recently release by Fidelity show that people usually retire earlier than they originally planned. Sometimes it's out of their control, but sometimes it's not.

Read MoreHaving an emergency fund is a crucial aspect of personal finance, it is the ultimate safety net for life’s unexpected events. Say goodbye to high-interest debt and hello to a low-risk, liquid account that gives you the freedom to handle any curveballs life throws your way.

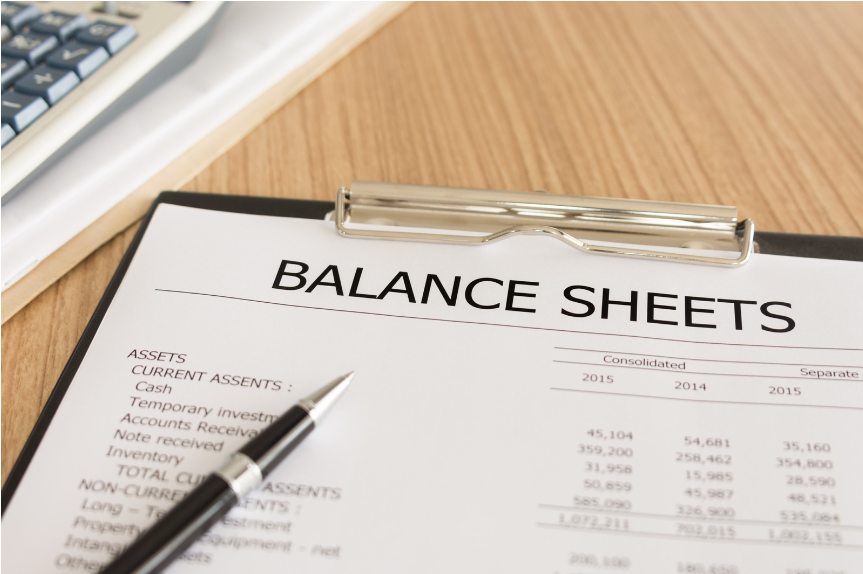

Read MoreAs a small business owner, you're likely familiar with the importance of keeping your business's balance sheet in good health. However, what you may not realize is that your business's financial health can also have a direct impact on your personal finances. Here are a few ways in which your business balance sheet could be hurting your personal balance sheet, and what you can do about it.

Read More