Planting Seeds for a Prosperous Future: The Powerful Advantages of Long-Term Investing

The recent news regarding interest rate hikes and the collapse of major banks may seem concerning to some investors. It is important however, to keep in mind that short-term fluctuations in the market do not necessarily reflect the long-term growth and productivity of the economy. In fact, long-term investing has historically provided favourable returns and has several benefits that can help you achieve your financial goals.

One benefit of long-term investing is the potential for greater market returns. The stock market has historically provided favourable returns over the long term. For example, the S&P 500 index has had a return of 1,173,622% since its inception or 10.13% per year, meaning $100 invested in 1926, would accumulate to $1,173,722. By investing for the long term, you can ride out the market's ups and downs and benefit from its overall growth.

Another benefit of long-term investing is the power of compounding. Compound interest is a powerful concept that allows your money to grow over time. It works by adding the interest earned on an investment back into the principal, so that the interest can earn interest, creating a powerful snowball effect that grows exponentially over time.

Long-term investing can be a cost-effective strategy for investors because it can provide capital gains tax discounts and reduce transaction costs and fees. By holding investments for longer periods, investors can reduce the frequency of buying and selling activities, resulting in lower transaction costs and fees. Additionally, if an investor holds their investment for more than 12 months they get a CGT discount of 50%.

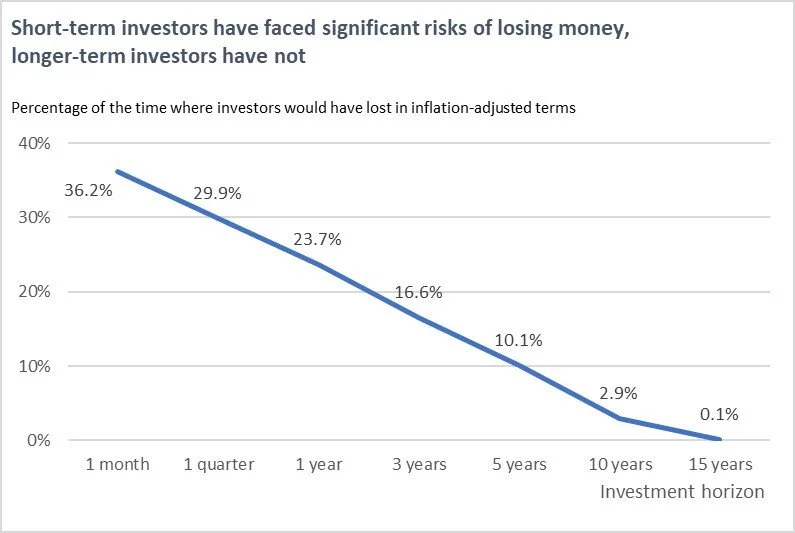

What the data shows:

Source: https://www.schroders.com/en-au/au/individual/insights/the-data-that-shows-a-case-for-long-term-investing/

This data is clear, taking short term bets in the stock market involves higher levels of risk, by investing for the long term, you increase your likelihood of success and therefore achieving your financial goals sooner. So don't let short-term noise distract you - stay focused on the long term and reap the rewards!

Written by Brad Laird – Salt Financial Group