Key Global Themes identified for 2023

2023 is poised to be a year of economic recovery and growth as the world continues to emerge from the COVID-19 pandemic. With this in mind, we have research several key investment themes are likely to emerge in the coming year.

Inflation

The number one theme on most fund managers and economist minds now is inflation. A quick glance at the Vanguard economic forecasts you will see a higher GDP growth in emerging markets such as China or India in comparison to US or UK markets.

In Europe, the war in Ukraine continues and pushes up food and energy prices, the Euro zone and UK will suffer due to their inability to redefine their supply chains in comparison to USA companies, such as Apple, being able to move manufacturing from a locked down China to open friendly countries like India.

Over in the west, developed economies desire to open new supply chain will continue. In the last couple of years, we have seen President Biden in the USA sign the ‘Inflation act’ which aim to move the critical mineral supply chain from China to friendlier countries such as Korea, Canada and Australia.

And in the east, despite a turn toward stricter market regulation, China’s political leaders, including President Xi Jinping, remain committed to a pro‑growth agenda. Vaccine campaigns should allow China to exit its zero‑COVID policy in the second quarter of 2023, clearing the way for an acceleration in economic and earnings growth.

As these inflation concerns are tipped to persist in the global economy, we will continue to see central banks fight it with rising interest rates (monetary policy) but at a lower rate than 2022 rate rises.

Return of Yield

When interest rates rose dramatically in 2022, causing a ‘bond’ bear market, the yields and relative valuations in the sector were improved. Now is the time to be selectively contrarian and If 2023 is dominated by concerns about growth, then valuations and currencies are attractive in many Emerging Markets (EM). We again believe that Central bank tightening may have peaked. However, the path in 2023 is likely to remain uneven, but again an easing of China’s zero COVID policies could be a significant tailwind.

Treasuries could resume their traditional role as portfolio diversifiers But, over the longer run, different tools may be needed. These could include:

Portfolio “Barbell” structures that divide bond allocations between long Treasuries and fixed income diversifiers such as high yield, floating rate, and Emerging Market debt as Emerging Markets have credit yields that look attractive relative to the developed markets but reflect elevated global growth concerns. More dovish central banks and signs of improving global trade could support the sector.

Alternative investments and Alternative strategies that seek to deliver positive absolute returns.

Real assets equities, such as energy, real estate, and metals and mining stocks remain an attractive hedge if inflation lingers. However, commodity and natural resource equities are vulnerable to global economic weakness—notably ongoing COVID and property market concerns in China that may be relaxed.

We are looking towards using more equity strategies that potentially offer downside risk mitigation in inflationary environments when Treasuries fail.

Credit risks in 2023

The top risk identified in 2023 by credit agency S & P Global include.

As Finance conditions and pressure to service debts by borrowers which could worsen during 2023, Structural risk of Cyber-attacks could worsen but pleasing the outlook within Aerospace and Defence is improving and looking forward, the prices of gas and energy should remain high which will benefit utilities providers. Although locally plans to cap energy prices to slow inflation may offset some gain for Australian providers.

The USA Government is currently now considering increasing its ‘debt ceiling’ and we expect a lot of noise around this, but please don’t consider it a reason to panic. After the debt ceiling was raised in August 2011, markets initially saw a relief rally. The S&P 500, for example, rose around 10% in the two months following the debt ceiling deal, as investors breathed a sigh of relief that the U.S. would not default on its debt. The yields on 10-year Treasury bonds also fell back down, as investors' concerns about a default decreased.

Global recession risks

With monetary tightening, there is an increased risk of a hard landing and a large recession such as the GFC late 2007-2009. Below we can see that typically in the past most recessions in the US have followed a period of tightening. Lower or negative GDP growth means there is a potential for recession and higher unemployment in the Euro area.

With these themes in mind how will we fair locally in Australia.

How did Australia avoid a GFC recession?

There were three contributing factors outlined by the Reserve Bank of Australia (RBA).

1. Low Australian banking exposure to the US housing market and US banks

2. Subprime and other high-risk loans were only a small share of lending in Australia

3. Chinese demand for Australian resources buoyed economic activity

So how do the factors above apply to 2023 and the identified risk factors

For 2023 we expect Australian equities to continue to outperform global equities. We favour Resources, REITs and Consumer Staples, are neutral on Banks and underweight Consumer Discretionary. During the year we expect to see improving relative performance from small cap and mid cap stocks.

2023 we recommend remaining overweight in the Resources sector.

Much of China’s growth over the last three decades has come from property development. That era is coming to an end. But different sectors should continue to drive a more moderate pace of economic growth.

Like 2008-200 and in 2020-2021 another uptick in infrastructure growth with continuation of the ‘Belt and Road’ initiative will see demand for Australian resources such as Steel, Oil &Gas.

Increase Merger and Acquisition activity.

BHP has recently made a take-over play for OZ minerals as it sees the increase in copper demand and price recovery brought upon by the need of the metal worldwide as we transition away from fossil fuels towards ‘green energy’ or the ‘electrification revolution’ as it has become known. As shown below we export commodity export to continue to rise.

Neutral on the ‘Big Four’ banks

Whilst subprime debt packaged up in AAA rated bond funds don’t seem to be a problem in 2023 as they were in 2008, Inflation in Australia remains relatively high comparatively to most of the develop economies.

As we expect the RBA to continue to raise rates in 2023, this will continue to improve profit margins in the banking sector but it may also increase the risk of default by borrowers.

Bank debt commonly issued by way of listed floating rate notes also have high floating yields and a relatively short duration profiles, this make floating rate notes attractive in rising rate environments.

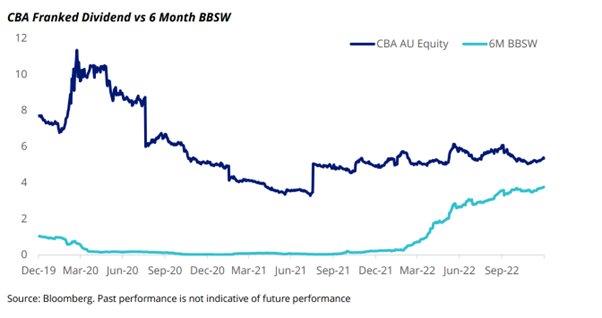

The recent Increases in RBA rates have increased the wholesale rates available to institutions (Bank Bill Swap Rates or BBSW) also the recent share price increase of banking stocks also see the margin between dividends yields compared to yields available to Deposit investors narrow.

Increasing structural credit risk identified by S& P Global such as cyber-attacks which during 2022 occured to Optus and Medibank private remain as a local risk to banks but also other consumer discretionary stocks.

In conclusion 2023 is likely to be an environment where cheap money Is no longer available and that central banks may struggle to continually raise rate without pushing the global economy in to recession. However, if the first 3 week in 2023 is to go by then the odds say that this year is looking to be a positive one.

Further reading on 2023 risk and possibilities, can be found via the following links:

By Ben Waite, Financial Adviser