Market Update - 27th July 2024

Written by William Cooper

Domestic

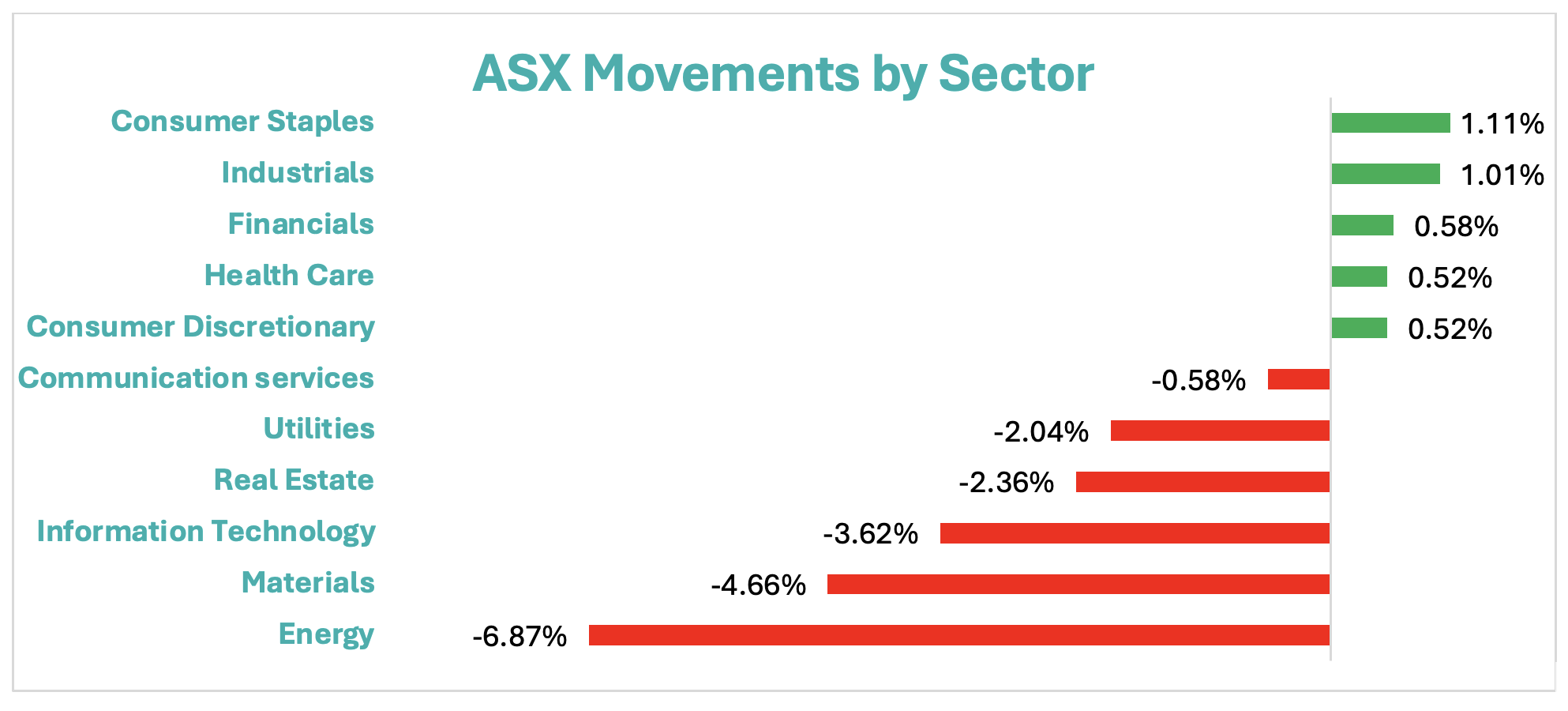

The Australian market is down 1.36% for the fortnight due to heavy losses across major industries. Attention is focused on the major losers for the fortnight who were led by IT, as well as the ever-important Australian Materials and Energy stocks.

IT saw a 3.4% single day loss following a major worldwide sell-off of IT shares, which occurred due to reports that the Biden administration is weighing-up tough trade restrictions if major semi-conductor companies continue giving China advanced technologies. Multi-month low prices of both iron and copper have driven the materials sector to slide 4.66% for the fortnight. Weakened demand out of China amidst their construction and economic stimulus issues is causing this decline. Materials is currently the worst performer this since year beginning – currently down 14% - significantly more than the next worse performer, Energy, which is down 4%. Energy has fallen by a 6.87% this fortnight, as oil prices have fallen to 6-week lows after speculation of a Gaza ceasefire and weakened Chinese demand.

The RBA is set to meet in two-weeks’ time to discuss its next interest rate policy decision and there is speculation of another rise amidst persistent inflation.

International

It has been a big fortnight of activity on the international landscape, from Trump’s assassination attempt, Biden withdrawing from his election campaign, global IT outages, looming ceasefires in Gaza, and economic challenges facing China. Investors are struggling to keep up with the bombardment of market altering news which has seen a significant increase in the activity of the CBOE VIX Index. You’re probably wondering what this indicator and what does it mean for the economy?

The Chicago Board Options Exchange Volatility Index (or CBOE VIX) is a measure of the volatility of the S&P 500 Index – the core index for U.S. equities. It is often known at the ‘fear index or fear gauge’. It reflects market expectations for volatility for the next 30 days. VIX is fundamentally complex in its calculations, but to keep it simple, as VIX’s price increases, expected volatility of the S&P 500 increases. This fortnight the VIX index has risen by 48%, from a price of $12.46 to $18.46 USD. Whilst historically the current price is not significant, it nonetheless reflects current uncertain investor sentiment towards the price movement of the S&P 500.

The S&P500 has experienced its worst week since April, but the tech-heavy Nasdaq has suffered even greater, falling 6.61% for the fortnight. Final quarter earnings releases from market goliaths Tesla and Alphabet have led to sector wide selloffs on Thursday, leading to the worst single day loss of Nasdaq since 2022.

The impact of poor U.S. performance set the tone for heavy losses in Asian markets, with the Hang Seng falling 7.04% for the fortnight, and the Japanese Nikkei 225 falling a 8.06% for the fortnight. Growing concerns about the Chinese economy and a stronger Yen contributes to these losses.

When reviewed in totality, both Australian and the UK markets have shown great resilience in the global landscape, a positive sign for Aussie investors.