How will the government’s proposed TAX CUTS affect you?

Changes to Individual income tax rates and thresholds from 1 July 2024.

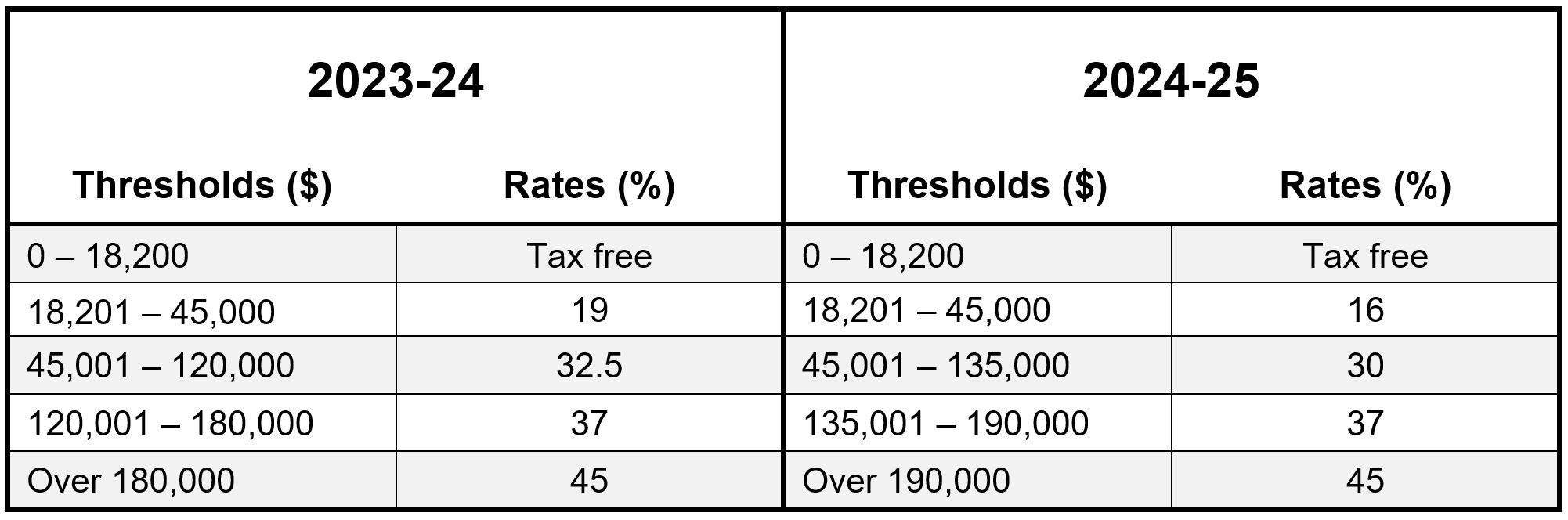

On 25 January 2024, the government announced proposed changes to the Individual income tax rates and thresholds from 1 July 2024. These changes are not yet law.

The proposed tax cuts will:

Reduce the 19% tax rate to 16%

Reduce the 32.5% tax rate to 30%

Increase the threshold above which the 37% tax rate applies from $120,000 to $135,000.

Increase the threshold above which the 45% tax rate applies from $180,000 to $190,000.

Please see the below table summary of the proposed changes:

For more information click here for The Treasury’s summary of the proposed changes, or click here for the Prime Minister’s address.

If you have any questions about these proposed changes, please do not hesitate to contact our team of Accountants to find out more.