Your Future, Your Super

You may have read in the media or even received a letter outlining that your fund has failed this performance test. What should you do and what should you know?

APRA is now required to conduct an annual performance test for My Super products. The assessment under the performance test is intended to hold RSE licensees (the Superannuation fund trustees) to account for underperformance through greater transparency and increased consequences.

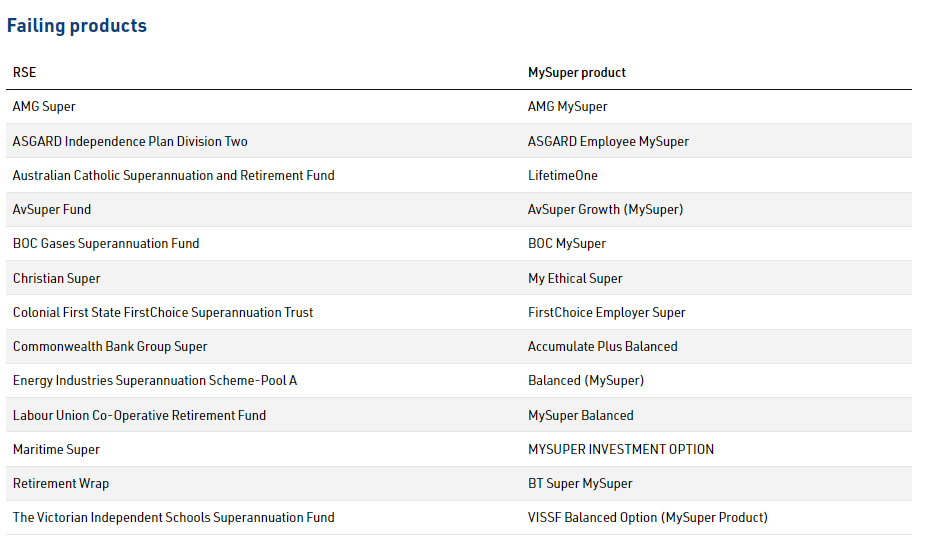

In August 2022, APRA released the results and out of a total of 69 My Super products, 64 passed, 1 failed for the first time and 4 failed for the second time.

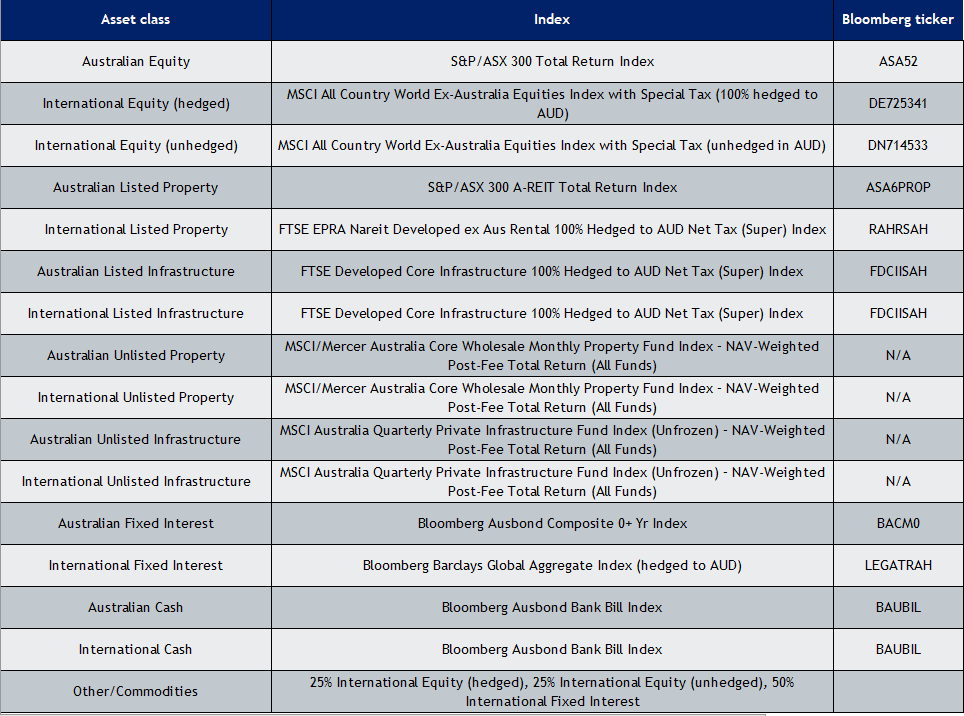

The performance test involves the calculation of a 'benchmark return', which is product-specific and derived using a product's strategic asset allocation data reported to APRA and the performance of a range of market indices.

For all failed products, RSE licensees are to:

Identify the causes of underperformance and develop and implement a plan to rectify this underperformance.

Assess the potential implications of failing the test on the fund and the sustainability of business operations.

Develop a plan to, if it becomes necessary in the best financial interests of members, close the product, transfer members to another fund/product and/or exit the industry.

Additionally, for second consecutive fail products, RSE licensees to:

• Ensure the product is closed to new members on the day following the notification.

• Return any contributions from new members (if made after 31 August 2022).

The indices specified in the Regulations for the ‘Your Future, Your Super’ performance test are listed in the table below.

Most importantly to be aware of is that the APRA test covers ‘MySuper’ options only. ’MySuper’ was enacted out of legislation in 2012 and since 2014 only funds offering a ‘MySuper’ product have been eligible to receive default superannuation contributions relating to new employees.

At a glance at these results, you may see a name you recognise as your own fund, however, upon closer look, your superannuation may not be invested within this ‘MySuper’ investment option, rather another investment with the same fund provider, if you have made an investment choice relating to your contributions.

If you are invested within this ‘MySuper’ option, most people will be entitled to make a choice on who will receive their contributions going forward and you may find that your current super fund will merge with another fund.

Importantly, regardless of a Pass or Fail mark, today is a chance to review your current superannuation to see where it may sit in comparison to its peers.

The Advisers at Salt Financial Group are available to educate you on your options and what may be the best suited to your own personal needs, goals and objectives going forward.

Written by Ben Waite – Financial Adviser at Salt Financial Group