Month In Review July 2022

Australian Equities

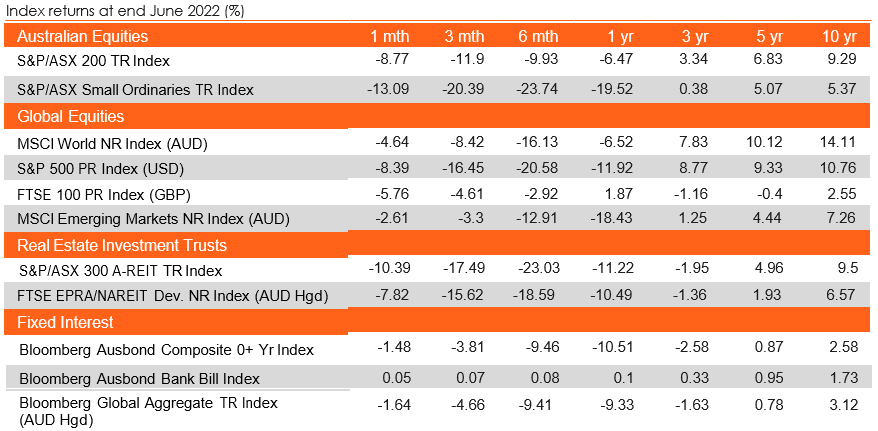

The Australian share market closed out the financial year with the S&P/ASX 200 falling sharply by -8.8% and ten out of eleven sectors finishing lower. Specifically, the Consumer Staples sector was the only positive finisher for the month (+0.2%). The Materials (-12.4%) and Financials ex-Property (-11.8%) sectors were the biggest laggards as recessionary fears weighed down risk assets across various sectors. Similarly, the Information Technology (-11.0%) sector’s poor year-to-date performance persisted.

The Consumer Discretionary sector finished lower as retail sales figures continued to surprise to the upside despite the increasing interest rate environment and pressure on consumers discretionary income. The accelerating sell-off in the Materials sector was driven by market participants weighing up the potential for recessionary risks given the tightening interest rate cycle and continued inflationary pressures. Likewise, similar sentiment around potentially subdued economic growth drove a sell-off in the Financials sector. Overall, the downtrend equities persisted as investors mulled various negative economic headwinds and continued hawkishness from central banks.

In June, all factors finished negatively with Momentum (-12.1%) and Equal Weight (-10.7%) being the worst performers. Similarly, Equal Weight (16.74%) and Momentum (15.6%) were the biggest laggards over the past quarter. Enhanced Value (+0.4%) remains the only positive year-to-date factor.

Global Equities

The first half of the year concluded with another challenging month in June as inflation and recession fears continue to erode investor risk sentiment worldwide. Developed markets sharply fell by -4.6% by month end, Global small caps followed the lead of their large cap counterparts closing with a more pronounced -6.1% decline. Emerging and Asian markets performed somewhat better than their developed market peers, but nonetheless still fell by -2.6% and -1.8% by month end.

As recession fears heighten and inflation pressure heats up around the globe, central banks continue to be challenged by their now delicate mandate of interest rate settings. Equal Weighted and High Dividend Yield factors were the best performers over the month returning -4.0% and -5.8% respectively, whilst Value and Quality factors were the laggards returning -7.6% and -7.3% respectively according to MSCI ACWI Single Factor Indices reported in local currency terms.

Property

Local and Global REITs continued to sell off during June. Domestically the A-REIT index (represented by the S&P/ASX 200 A-REIT Accumulation Index) ended the month –10.3% lower, providing the worst monthly performance since March of 2020.

The index has returned –23.5% on a total return basis YTD to 30 June. Global REITS slightly outperformed the local REIT index, albeit still experiencing a significant drawdown of –7.6% during the month. Despite poor performance, globally the all-Equity REITs index (-6.4%) remains ahead of the Total Stock Market Index (-10.7%) since the Russia and Ukraine conflict. Domestically, infrastructure (represented by the S&P/ASX Infrastructure Index) has turned negative this month, returning –3.2% in June and 13.1% YTD.

June was quiet on the M&A front across the A-REIT sector. SCA Property Group (ASX: SCP) entered into an agreement with Centuria Capital Group’s (ASX:CNI) subsidiary, Primewest, to acquire five shopping centres across Australia for an agreed price of $180mn. This represents a 24% premium to book value for Centuria and provides a guaranteed performance fee of $5.7mn.

The Australian residential property market experienced a –0.9% change month on month represented by Core Logic’s five capital city aggregate. Sydney (-1.6%) and Melbourne (-1.1%) were the worst performers whilst Adelaide continues to show strength (+1.3%) with Brisbane (+0.2%) and Perth (+0.4%) staying relatively neutral.

Fixed Income

Australian Fixed Income markets have delivered another month of poor returns in June, as the Reserve Bank of Australia continues to tighten monetary policy, raising the cash rate by 50bps in both their June and July meetings to a total of 1.35% at present. Despite this, yields remained fairly stable at the short end of the curve with such increases having already been priced in, however yields continued to increase at the 10-year level by approximately 18bps, resulting in a steepening of the yield curve. Credit spreads also widened considerably throughout June, which further contributed to the Bloomberg AusBond Composite 0+ Yr Index’s poor result of -1.5% over the course of June.

Internationally the story remains similar, as central banks continue raising rates in an effort to contain inflation. This can be seen in the US Federal Reserve, which raised the federal funds rate by 75bps in its June meeting, the first hike of such a magnitude since 1994. However, fears of a recession have seen yields fall further out on the yield curve. Overall performance in global Fixed Income markets has been weak throughout June, as the rate increases at the short end of the curve have been more impactful. The Bloomberg Barclays Global Aggregate Index (AUD Hedged) Index returned -1.6% throughout the month, with currency fluctuations resulting in the hedged variant returning 1%.

Australia

The RBA raised rates by 50 bps in June, bringing the cash rate to 0.85%. The unemployment rate remained at 3.9% in May, above expectations of 3.8%. Retail sales increased by 0.9% in May, bringing the annual increase to 10.4%.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell 4.5% in June, down for the seventh month in a row amid surging inflation and rising interest rates. The NAB Business Survey for May dropped 4 points to 6, as business faces a new environment of higher inflation, rising interest rates, and risks to global growth.

The S&P Global Composite PMI declined to 52.6 in June, with, manufacturing output still hampered by supply chain constraints. The trade surplus widened to a record high of $15.97 billion in May, easily beating market forecasts of a$10.73 billion surplus, with the value of exports rising amid solid global demand and soaring commodity prices.

Global

New variants have caused global Covid-19 cases to rise, surpassing 548.5 million cases and 12 billion vaccine doses administered as at the end of June. Inflation, especially rising energy and food costs, continues to be a global issue spiking in most economies. As a result, consumer sentiment remains low in most developed economies. The war in Ukraine continues to drag on the global economy with the OECD slashing its global growth forecast to 3% and doubling the inflation projection to nearly 9%.

The US Federal Reserve raised rates by 0.75% in June in an effort to bring inflation under control. Fed Chair Jerome Powell reiterated the commitment to do- whatever-it-takes to control high inflation. Inflation rose 1.0% in May, above the expected increase of 0.7%, with the annual rate rising to 8.6%, as supply disruptions persist, and energy and food prices remain elevated.

Non-farm payrolls added 372,000 jobs in June, well ahead of the forecast 268,000. The unemployment rate in June was unchanged at 3.6%. Personal incomes grew 0.5% in May, which is in line with forecasts. Consumer sentiment dropped to 50 in June, well below the anticipated 58. Retail sales unexpectedly fell 0.3%in May, the first decline so far this year, but the annual rate grew 8.1%.

The S&P Global Composite PMI fell to a five-month low of 51.2 in June with the first contraction in manufacturing production in two years. PPI increased 0.8% in May which matched forecasts, with the annual rate slightly down at 10.8%.

The trade deficit narrowed by US$1.1 billion to a five- month low of US$85.5 billion in May. This compares to the market forecast of US $84.9 billion.

The annual inflation rate in the Euro area rose to 8.8% in June, above the anticipated 8.4% and strengthening the case for the ECB to raise rates for the first time in 11 years at its next meeting.

Consumer confidence fell to -23.6 in June which is in line with expectations. Retail sales rose 0.2% in May, up from 1.3% contraction in the prior month, and against expectations of 0.4%. Annual retail sales increased 0.2% May, as rising prices weigh on affordability.

Unemployment edged lower to 6.6% in May compared to the anticipated 6.8%. The S&P Global Composite PMI fell to 51.9 in June as services sector growth slowed sharply amid slower inflows of new business.

PPI rose 0.7% in May, while the annual rate fell to 36.3%, below market expectations of 36.7%.

In the UK, the Bank of England increased the cash rate by 25bps to 1.25% in June. Inflation rose 0.7% in May, above the 0.6% expected, with the annual inflation rate rising to 9.1%. Inflation is at the highest rate for 40 years, largely due to elevated food and energy prices.

The unemployment rate rose to 3.8% in April, above the expected 3.6%. Consumer confidence fell to -41 in June adding to concerns of a pullback in consumer spending amid sluggish economic growth. Retail sales fell 0.5% in May, compared to the expected 0.7% fall, with the annual rate coming in at -4.5.

The PMI composite index remained at 53.1 in June, above the 52.6.8 expected, with services activity remaining resilient. PPI dropped 1.6% in May with the annual rate to rising 15.7%.

In China, CPI came in at -0.2% in May, with the annual rate flat at 2.1%, below the expected2.3%. The unemployment rate declined to 5.9% in May, in response to efforts by the government to revive the economy by easing COVID-curbs in several key cities.

The Caixin Composite PMI jumped to 55.3 in June, amid the improving COVID-19 situation and implementation of a package of measures to support economic recovery. The Manufacturing PMI climbed to 51.7 in June from 48.1 in May, topping market forecasts of 50.1. Annual industrial production unexpectedly grew by 0.7% in May, easily beating the market consensus of a 0.7%.

Annual retail sales declined by 6.7% in May, compared with market expectations of a 7.1% fall, as regular virus testing and other stringent controls continued to hinder consumer activity.

As widely expected, the Bank of Japan left its key short- term interest rate unchanged at -0.1% and that for 10- year bond yields around 0% during its June meeting. Policymakers viewed that Japan's economy has picked up, despite some weakness due to the impact of COVID-19 and surging commodity prices.

The annual inflation rate came in at 2.5% in May, marking the ninth month in row of increases.

Japan’s unemployment rate unexpectedly rose to 10bps to 2.6% in May, above the anticipated 2.5%.

Japanese consumer confidence dropped to an 18-month low of 32.1 in June, amid the ongoing global uncertainty. Retail sales increased 0.6 % in May, with the annual rate rising 3.6%, exceeding the anticipated 3.3%, as the government has lifted all COVD-19 restrictions.

The Composite PMI came in at 53.0 in June, with the PMI Services coming in at 54.0, the largest increase in services activity for nine years.

On June 10, Japan eased its COVID-19 border control measures to accept foreigners participating in package tours with tour conductors.

Currencies

The Australian dollar slumped over the month of June, closing -3.8% lower relative to the US dollar and -1.3% lower in trade-weighted terms by month end. A greater than expected rate rise from the RBA provided support early in the month before global equity market sell-offs and negative risk sentiment headwinds sent the AUD into freefall mid-month to a low of 0.69 on June 15.

Ref: Lonsec - Market reports