Month in Review May 2022

Australian equities

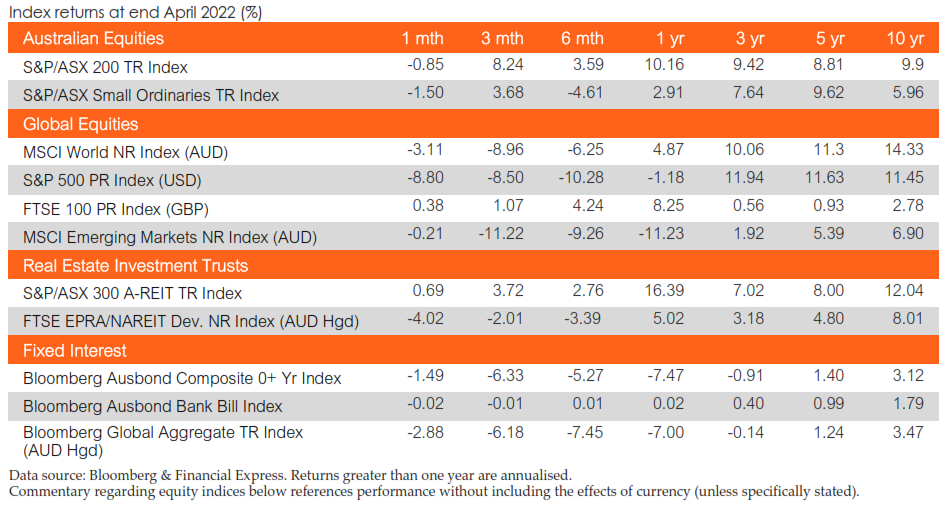

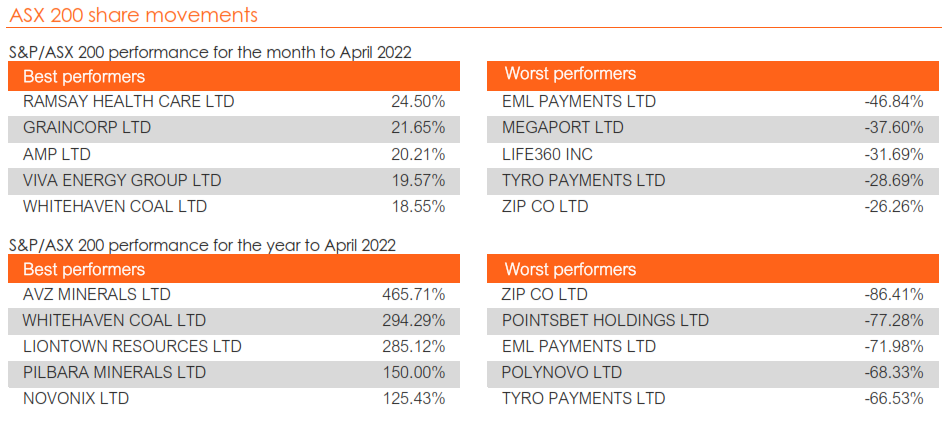

The Australian market closed for the month of April with the S&P/ASX 200 down -0.85% with seven out of eleven sectors finishing higher. Utilities led the index (+9.33%) to continue its strong performance, with Industrials (+3.47%) and Consumer Staples (+3.29%) all performing well. The main detractors of the Index were Technology (-10.37%) and Materials (-4.33%).

High exposure to Resources shares and low exposure to Technology companies has meant the Australian Share Market remains an outperformer relative to global peers. The Technology sector suffered a sizeable selloff after strong March performance, continuing the trend of high volatility in the sector. Macroeconomic uncertainty clouded much of the month’s headlines with the inflation figures hitting 20-year highs. Australian investors took precautions flocking to defensive sectors over the month leading to the positive performance in Utilities and Consumer Staples. Market volatility is expected to remain high in the short-to-medium term with China’s COVID lockdowns hampering growth with increasing supply chain issues.

In April, Enhanced Value (+4.92%) and Low Volatility (3.10%) were the top performing factors. Neutral or negative performance was seen across most factors with Momentum (-1.95%) and Growth (-1.92%) being the weakest factors. Over the past 12 months Enhanced Value is the top performer (+22.5%).

Global equities

Global markets descended further over the month of April as 'zero-COVID' lockdowns in China added to prolonged geopolitical risk pressures in Ukraine. Developed markets fell by -3.2% by month end, Global small caps performed modestly better than their large cap counterparts closing with a -2.5% loss. Emerging and Asian markets fared better than the previous month, falling by -0.2% and -1.6% respectively. Returns in AUD were assisted by the softer AUD over the month as signified by the local currency return of the MSCI World Ex Australia Index (LCL) of -7.0%.

Quantitative tightening signalling from central banks has joined geopolitical uncertainty as core focuses for investors as heightened inflation continues to weigh on investor sentiment. Dividend yield and value factors were the best performers over the month returning - 1.8% and 2.6% respectively, whilst momentum and quality factors lagged returning -9.7% and -7.9% respectively according to MSCI ACWI Single Factor Indices reported in local currency terms.

Property

The domestic and global REIT indexes slowed during April, with the S&P/ASX 200 A-REIT Index (AUD) (XJO) returning 0.6% for the month and global REIT’s, represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged), retracing by - 4.1%, giving back its March advances. The S&P/ASX 200 A- REIT index has returned -6.6% YTD. Global REIT’s, especially within the industrial sector, experienced a sharp sell off in late April after Amazon’s CFO stated "we have too much space right now versus our demand patterns" (Nareit, 2022). Australian infrastructure performed well during April, a result of strong inflation-linked revenue potential, with the S&P/ASX Infrastructure Index TR advancing 6.1% for the month, 15.9% YTD.

April was quiet on the M&A front for the Australian A- REIT sector. Dexus (ASX: DXS) announced a Share Sale and Purchase Agreement with Collimate Capital Limited, a wholly owned subsidiary of AMP Limited, to acquire their real estate and domestic infrastructure equity business. Consideration includes $250m in upfront cash and an earn out consideration of $300m, subject to various factors.

The Australian residential property market experienced a +0.3% change month on month represented by CoreLogic’s five capital city aggregate. Hobart was the worst performer (-0.30%), with Sydney (-0.20%) and Melbourne (0.0%) not far behind. Adelaide and Brisbane continued to show strength, advancing 1.9% and 1.7% MoM respectively.

Fixed income

Fixed interest markets have continued their downturn throughout April, as monetary policy tightens internationally in response to continued elevated levels of inflation. Australia saw yields rise, primarily at the short end of the yield curve, as first quarter inflation of 5.1% proved higher than expected. The yield for 2-year Australian Government bonds increased by approximately 30bps over the course of April, while 10- year Australian Government bonds increased by only around 10bps. Credit spreads also continued to widen over the month, which contributed to the Bloomberg AusBond Composite 0+ Yr Index returning -1.49% over the course of April. Market expectations of increasing interest rates proved accurate, as in their meeting on 3rd May the Reserve Bank of Australia increased the cash rate by 0.25%, an action which has seen yields shoot higher following the announcement.

Internationally the global tightening cycle has been ramping up in an effort to combat inflation. The US Federal Reserve raised the federal funds rate target by a full 50bps on the 4th of May. Rising global yields have resulted in a return of -2.88% for the Bloomberg Global Aggregate Index (AUD Hedged), with currency fluctuations resulting in the unhedged variant returning -0.12%.

Australia

The RBA left the cash rate unchanged at 0.1%, with pressure mounting for an increase in May on the back of rising inflation. Inflation increased 2.1% in March, pushing the annual rate to 5.1%.

March’s unemployment was unchanged at 4.0%. slightly above the anticipated 3.9%. Retail sales increased by 1.6% in March.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 0.9% in April, amid rising inflation, threat if interest rate rises and widespread flooding across the east coast. The survey suggested the government’s budget in March had a limited impact on the national mood, even though it contained pre- election tax breaks and cuts to fuel excise.

The NAB Business Survey for March saw a 3 point increase in business confidence to +16 points. Trading conditions and profitability also rose markedly, suggesting demand remains strong, particularly in the retail sector.

The S&P Global Composite PMI rose to 55.9 in April, with both manufacturing and service sector output growing, driven by higher demand as COVID restrictions eased.

The trade surplus increased $9.3 billion in March, beating market forecasts of $8.5 billion, amid a decline in imports.

Global

Global Covid-19 cases continue to rise with numbers surpassing 513 million cases and 11.5 billion vaccine doses administered as at the end of April. Continuing outbreaks in China have caused ongoing restrictions and threaten to again impact global supply chains. The Russian war on Ukraine continues to put pressure on energy prices and caused the IMF to downgrade global annual growth projections to 3.6%. Rising inflation remains a concern, with the IMF calling it a ‘clear and persistent danger’ for the global economy.

Inflation in the USA jumped 1.2% in March, in line with forecasts, pushing the annual rate to 8.5%, the highest since December 1981 and putting pressure on the Federal Reserve to increase interest rates at their next meeting.

Consumer sentiment increased to 65.2 in April, well about the expected 59.0. PPI increased 1.4% in March, above the expected 1.1% increase, and marking the largest increase since December 2009.

Non-farm payrolls added 428,000 jobs in April, above the anticipated 391,000, whilst the unemployment rate was unchanged at 3.6%, above the expected 3.5%. Personal incomes grew 0.5% in March, above the anticipated 0.4%.

The S&P Global Composite PMI dropped to 56 in April as the expansion of manufacturing production was offset by softer service growth.

The trade deficit widened sharply to a record high of $109.8 billion in March, as a broad-based rise in prices, especially for energy lifted imports by 10.3% .

The European Central Bank held interest rates at 0.0% during the April meeting, consistent with the prior March quarter, with President Lagarde noting the timeline for potential interest rate increases has not been determined.

The annual inflation rate rose to a fresh record high of 7.5% in April and is now over three times the 2% ECB target. Energy price increase have slowed but remain extremely high.

Consumer confidence declined to -22 in April as the war in Ukraine and rising inflation continue to dampen consumer’s moods. Retail sales fell 0.4% in March, pushing the annual rate to just 0.8% as soaring prices cause customers start to cut back on some purchases.

Unemployment was steady at 6.8% in March, but slightly above the anticipated 6.7%.

The S&P Global Composite PMI increased to 55.8 in April, the sharpest growth in private sector activity in seven months.

PPI rose to 5.3% in March, while the annual rate increased 36.8%, marginally above the expected 36.3%.

In the UK, GDP rose 0.1% in February, lower than the 0.3% forecast and down on the 0.8% growth in the month prior.

Inflation rose 1.1% in March, above the 0.7% expected, with the annual inflation rate rising to 7.0%. The unemployment rate fell to 3.8% in February, in line with expectations.

Consumer confidence fell to -38 in April, its lowest level in since July 2008 as rising interest rates and inflation takes a toll. Retail sales dropped 1.4% in March, well down on the anticipated 0.3% decline and bringing the annual rate to 0.9%.

The PMI composite index came in at 58.2 in April, down on the 60.9 in March.

PPI is 2.0% in March, bringing the annual rate to 11.9%.

China’s GDP grew 1.3% in the March quarter, with the yearly growth rate coming in at 4.8%, ahead of the 4.4% expected and the 4.0% recorded in December.

CPI was flat in March, slightly beating the anticipated 0.1% fall, with the annual rate increasing to 1.5%. The unemployment rate was 5.8% in March, above the government’s target of 5.5% for the year.

The Caixin Composite PMI plunged to 37.2 in April, with both manufacturing and services activity contracting. The Manufacturing PMI fell to a 26 month low of 46 in April as COVID -19 outbreaks took a toll on the economy.

Annual industrial production came in at a 5.0% in March, slightly ahead of the 4.5% expected, however down on the 7.5% in February.

Annual retail sales fell -3.5% in March, below the -1.6% expected and well down on +6.7% in the prior month.

The merchandise trade surplus widened to USD$51.12 billion in April, above the USD$50.65 billion expected, as year over year exports increased by 3.9% whilst imports were flat.

COVID-19 outbreaks continue to cause lockdowns in major centres, with Beijing the latest city to impose restrictions, and impacting global supply chains.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% during its April meeting. It also revised its inflation forecast up to 1.9% but believes inflation is largely driven by one time causes such as the recent spikes in energy prices so is projected to ease to 1.1% in 2023.

Policymakers cut the FY 2022 GDP growth forecasts to 2.9% from 3.8% forecast made in January.

Japan's annual inflation rate rose to 1.2% in March, marking the seventh month in row of increases but remaining well below the BOJ target of 2%.

The Japanese unemployment rate dropped 10bps to 2.6% in March, better than the anticipated 2.7%.

Japanese consumer confidence edged up in April to 33, the first improvement in six months after the government ended the quasi-state of emergency in late March following a decline in new COVID-19 infections and increasing vaccinations. Retail sales increased 2 % in March, with the annual rate rising 0.9%, exceeding the anticipated 0.4% as consumption rebounds following the improvement in the COVID-19 situation.

The PMI Composite Final came in at 51.1 in April, above the anticipated 50.9, while the PMI Services Final came in at 50.7 in April, above the 50.5 expected.

Currencies

The Australian dollar dived over the month of April closing -5.8% lower relative to the greenback and -0.8% in trade-weighted terms. Dropping to its lowest level since February this year, the dollar continues to be challenged by investor risk sentiment. Protracted geopolitical risk in Ukraine, global central bank quantitative tightening and recently China's 'zero- COVID' lockdowns have had the greatest impact on the strength of the AUD in April.