Month in Review - March

Australian equities

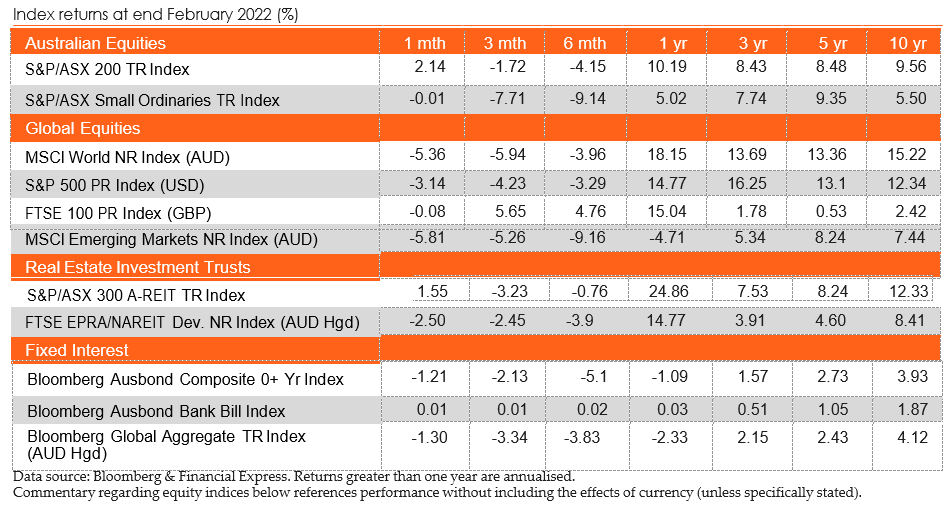

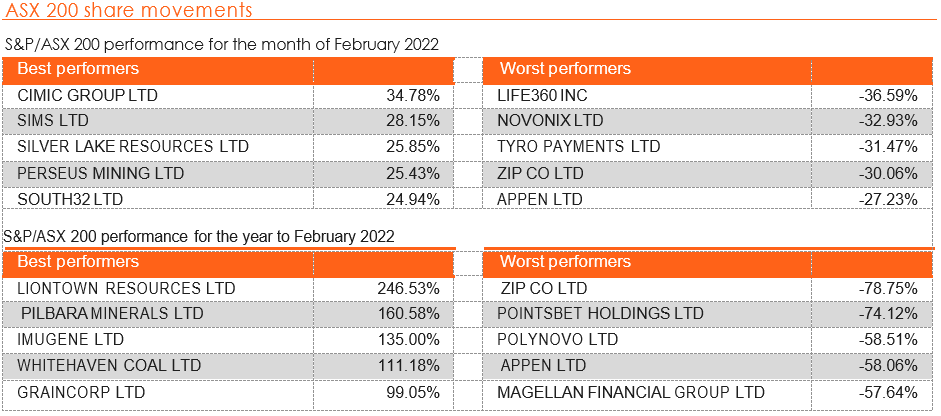

The Australian share market finished February 2022 with the S&P/ASX 200 rebounding +2.14% and seven out of eleven sectors finishing higher. In particular, the Energy sector (+8.6%) led the Index higher with Consumer Staples (+5.6%) and Materials (+5.2%) also performing well. The Information Technology sector (-6.6%) continued its fall whilst the Consumer Discretionary sector (-5.0%) performed poorly.

The Energy sector was driven higher by surging oil prices amid the geopolitical tensions between Russian and Ukraine. Meanwhile, Consumer Staples performed strongly as investors looked for defensive exposure, with the Materials sector also finishing positively due to surging commodity prices. The Information Technology sector continued its slide as volatility and impending worldwide interest rate rises provided a headwind for growth stocks. Overall, the catalysts for the month were the geopolitical issues in Ukraine as the war and sanctions continued to intensify. This resulted in market volatility as investors mulled the effects on worldwide monetary policy response and inflationary concerns.

In February, Enhanced Value (+5.3%) and Value (5.0%) were the top performers amongst factors. All factors finished positive except for growth (-0.6%). Over the past 12 months, both value strategies (+17.5%) are the strongest performers, with growth (-9.0%) providing the lowest year-to-date returns.

Global equities

Global markets were battered over the month of February as geopolitical fears evolved into a reality in Ukraine. Developed markets closed -5.5% lower by month end, Global small caps fared better than their large cap counterparts closing with a -2.5% loss. Emerging and Asian markets followed similar downward trends with monthly returns of -5.8% and - 4.3% respectively. Noting that all aforementioned figures are reported in Australian dollar terms.

As expected, the emerging conflict between Russia and Ukraine commanded the attention of investors over the month dampening confidence across the globe. Momentum and growth factors led the pack over the month returning -0.2% and -0.9% respectively, the worst performing factors were quality and momentum closing -4.1% and -2.2% lower respectively according to MSCI ACWI Single Factor Indices reported in local currency terms.

Property

The S&P/ASX 200 A-REIT Index (AUD) consolidated during February, finishing 1.4% higher MoM. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) continued its drawdown, closing a further - 2.7% lower for the month of February and totalling - 8.1% YTD. Within the AREIT landscape, industrial REITs have significantly outperformed office and retails over the past 12 months and during the recovery, but COVID-related restrictions easing across the community could see improved sentiment within the office and retail subsector. Additionally, February HY22 results were generally positive across the AREIT sector, with a number of index constituents beating earnings expectations.

February saw some activity across the retirement and lifestyle segments. Stockland (ASX: SGP) announced the sale of its retirement living business to EQT Infrastructure for $987m, broadly in line with its book value. Ingenia Communities Group (ASX: INA) announced both an acquisition of a partially developed lifestyle community in South East Queensland and the acquisition of three lifestyle communities in Melbourne. The domestic housing market rose by 0.3% MoM in February, as reported by CoreLogic's 5 capital city aggregate. Sydney ‘all dwellings’ was the only negative reading, with -0.1% MoM change. Brisbane (inc. Gold Coast) led the charge, advancing 2.0% MoM.

Interestingly, CoreLogic reported that the lower value segments of the market are now outperforming, with the lowest 25% of capital city home values increasing by 3.5% in three months to January, compared to the top 25% of capital city home values rising by 1.9% for the same period.

Fixed income

Fixed Income markets continued their poor start to 2022, posting significant losses in February. In the Australian market, the bulk of the poor returns came from markets continuing to sell-off over fears of higher inflation and corresponding rate hikes, with the yield for 10-year Australian Government Bonds increasing by more than 25bps over the course of February. This increase hit across the entire Yield Curve, with the 2-year yield increasing by a similar amount. Despite these selloffs, in their meeting on 1 March the Reserve Bank of Australia (RBA) maintained the Cash Rate at 0.1% and reiterated that they intend to see both inflation sustainably within their 2-3% target range, and higher levels of wage growth, before increasing rates, and currently the RBA’s board does not have sufficient conviction that either of these criteria have been met.

As such, the movement of the risk-free curve was the main factor driving Australian bond market performance, with the Bloomberg AusBond Composite 0+ Yr Index returning -1.2% over the course of February. Australian credit spreads also widened substantially over the course of the month, which further contributed to the observed poor performance.

International bond markets also sold off during February, primarily driven by the US, which balked at a CPI level of 7.5% over the year to January 2022. Market participants are almost unanimously expecting a rate rise in the Federal Reserve’s March meeting, with the bulk of discussion concerning the size of the increase rather than whether or not one is likely to occur. This resulted in a return of -1.3% in the Bloomberg Global Aggregate Index (AUD Hedged), with a weakening AUD resulting in a return of -4.1% for the unhedged variant. Notably, this index features a small 0.3% allocation to Russian markets, which experienced huge devaluations resulting from international sanctions following Russia’s invasion of Ukraine, contributing to the month’s negative return.

Economic News

Australia

The RBA left the cash rate unchanged at 0.1% as widely expected. The board stated that the global economy was continuing the recover from the pandemic, but it expects inflation to rise on the back of higher petrol prices and energy costs.

GDP gained 3.4% in the fourth quarter of 2021, above the 2.7% expectation and rebounding from the prior quarter decline of 1.9%. This was the strongest growth rate since the third quarter in 2020, boosted by a rebound in household spending following restrictions easing on the east coast. The yearly GDP rate increased from 3.9% to 4.2%.

Retail sales surprised to the upside in January, gaining 1.8% and reversing from the 4.4% fall in December which was the first decrease in retail sales since August.

January’s unemployment rate was unchanged at 4.2%, in line with expectations.

The Westpac consumer sentiment index declined 1.3% to 100.8 in February, weighed down by concerns over the rising cost of living and prospects of higher interest rates.

The Markit Composite PMI rose to 56.6 in February, rebounding from January's 46.7, with both services and manufacturing output returning to growth.

The trade surplus increased to $12.89 billion in January from an upwardly revised $8.82 billion in December, as exports rose amid solid global demand.

Global

Global Covid-19 cases continue to rise with numbers surpassing 437 million cases and 10.5billion vaccine doses administered as at the end of February. Russia’s invasion of Ukraine has caused volatility in global stock markets and energy prices to rise with the Brent crude price at over $100 a barrel at the end of February, putting additional pressure on already high global energy costs.

Central bankers stated that the war in Ukraine will affect the world economy across a variety of channels from higher prices to dampened spending and investment, though it is unclear what the ultimate impact will be.

In the US, Annual inflation accelerated to 7.5% in January, the highest since February of 1982 and well above market forecasts of 7.3%, as soaring energy costs, labour shortages, and supply disruptions coupled with strong demand weigh.

Consumer confidence fell slightly from a downwardly revised 111.1 to 110.5 in February.

Non-farm payrolls rose 678,000 in February, the most in seven months and way above market forecasts of 400,000, whilst the unemployment rate came in at 3.8% in February, slightly below the 3.9% expectation and down on the 4.0% in January. Personal incomes were flat in January, beating the expected 0.3% fall.

PPI grew 1.0% in January, following on from the 0.4% growth in December and ahead of the 0.5% expected, with the annual rate remaining at 9.7%.

The Markit Composite PMI was 55.9 in February 4.8pts above January’s result and broadly in line with expectations of 56.0. The Philadelphia Fed Manufacturing Index came in at 16.0 in February 3.7pts below expectations and 7.2pts lower than the January result.

The trade deficit came in at a record US$89.7 billion deficit in January, an increase on the revised US$82billion deficit in December and above the expected US$87.1 billion.

Interest rates across the Euro region held at 0.0%. The inflation rate increased 0.3% in January, with energy contributing the bulk of this increase. The annual rate fell slightly to 5.1%, but well ahead of the 0.9% of a year ago.

Economic sentiment increased to a 3-month high of 114 in February, beating market forecasts of 113. Unemployment fell to a record low of 6.8% in January from 7% in December and from 8.3% a year ago, and below market forecasts of 6.9%.

The Markit Composite PMI rose from 52.3 to 55.5 in February, ahead of the 52.7 expected. This accelerated expansion in business activity was accompanied by a survey-record increase in prices charged for goods and services.

Retail Sales grew by 0.2% in January, gaining some momentum after falling 3.0% in December. The annual rate came in at 7.8%, well below the expected 9.1%.

The Russian invasion of Ukraine has added extra pressure to energy supply and prices as Europe relies heavily on Russian energy. Germany also suspended the Nord Stream 2 gas pipeline project, a gas pipe connecting Russian gas to Germany. This is significant because Germany essentially shut down its nuclear power stations opting for gas via the new pipeline.

PPI rose to 5.2% in January, while the annual rate increased 30.6%, well ahead of the 27% expected.

In the UK, the base interest rate increased to 0.50% in February, as expected with the central bank expecting inflation to increase further in coming months, to close to 6% in March, before peaking at around 7.25% in April.

Inflation declined to 0.1% in January, slowing on the 0.5% rise in December. The annual rate, however, rose to 5.5%, the highest reading since March 1992.

The unemployment rate was flat at 4.1% in December. Consumer confidence dropped to its lowest level in 13 months at -26 in February largely due to persistently high inflation.

The PMI Composite index came in at 59.9, 5.7pts higher than the 54.2 January result and 0.3pts below expectations whilst the services index came in at 60.5, 6.4pts up from the 54.1 January result and 0.3pts below expectations.

Retail sales rose 1.9% in January, ahead of the 1.0% expected, rebounding from the 4% fall in December and pushing the annual rate to 9.1%.

China announced target rates for key economic indicators for 2022 at is annual parliamentary - GDP growth target of “around 5.5%”, unemployment rate in cities of “no more than 5.5%” and a consumer price index of “around 3%”.

China's annual inflation rate fell to 0.9% in January from 1.5% a month earlier and compared with market forecasts of 1%. This was the lowest reading since September 2021, as the cost of food dropped the most in four months.

The Caixin Manufacturing PMI unexpectedly rose to 50.4 in February, beating market consensus of 49.3. while the Caixin Composite PMI was flat at 50.1, which was below the expected 50.8.

China’s trade surplus widened to US $115.95 billion in January – February combined, easily beating market forecasts of US$99.5 billion.

The 2022 Winter Olympics in Beijing were held against a background of ‘Covid Zero’ and a limit on spectators.

No meeting by the Bank of Japan was scheduled for February so rates remain unchanged at -0.10%.

Annual inflation was 0.5% in January, slightly down on the 0.8% December result. Japan’s unemployment rate rose10bps to 2.8% in January, against expectations of 2.7%.

Japanese consumer confidence declined to a 9-month low of 35.3 in February from 36.7 in the previous month, amid extending Covid-19 restrictions in some regions.

Retail sales decreased 1.9 % in, while the yearly rate improved 1.6, which was higher than the expected 1.4%%.

Toyota, Honda and Mazda halted exports to and production in Russia, citing difficulties in procuring parts and logistical hurdles.

Currencies

The Australian dollar regained lost ground in the month of February closing 2.7% higher relative to the greenback and 2.2% in trade-weighted terms. Despite geopolitical pressure developing as a result of the Russia-Ukraine conflict, the AUD remained fairly stable with its monthly high-low range being tighter than that of January (Jan: 0.69-0.73, Feb: 0.70-0.73). Investor confidence will continue to be challenged as geopolitical events unravel over the coming months, albeit the AUD is seemingly receiving some support via heightened commodity prices as a result of the conflict.