SMSF Myths Busted

Is a Self-Managed Super Fund (SMSF) right for you? Or do you already have a SMSF but want to make it work harder for you?

Over 900,000 Australians run their own SMSF. But the news media is in a frenzy currently about SMSFs and property investments.

We understand that SMSFs don’t suit everyone, so it’s important you get the right information to decide for yourself.

To assist you to make a correctly informed choice, here are the FACTS:

Why do people set up their own SMSF?

• To have control over the investment choices with their super assets.

• To invest in unlisted assets, such as private equity or a property.

Is it expensive to set up a SMSF?

No, it isn’t. You need a SMSF Trust Deed (the document that contains all of the rules for running your super fund) and we recommend you incorporate a Company to be the Trustee (the decision maker) for the SMSF. Our price for this is $3,500 plus GST (plus ASIC fee of $538), which includes preparation of all required documents and everything legally required for a SMSF. For example, if you have $200,000 in super, then the setup costs are 1.75% of your super balance – very low for setting up your financial future!

What are the ongoing running costs of a SMSF?

The ongoing costs start from as little as $200 + GST per month for the administration of your SMSF (includes tax returns, annual financial statements, minutes of Trustee’s meetings) plus $500 + GST for the annual audit of your SMSF. Additional cost may include an annual ASIC fee if you have a corporate trustee.

How does a SMSF compare with standard super?

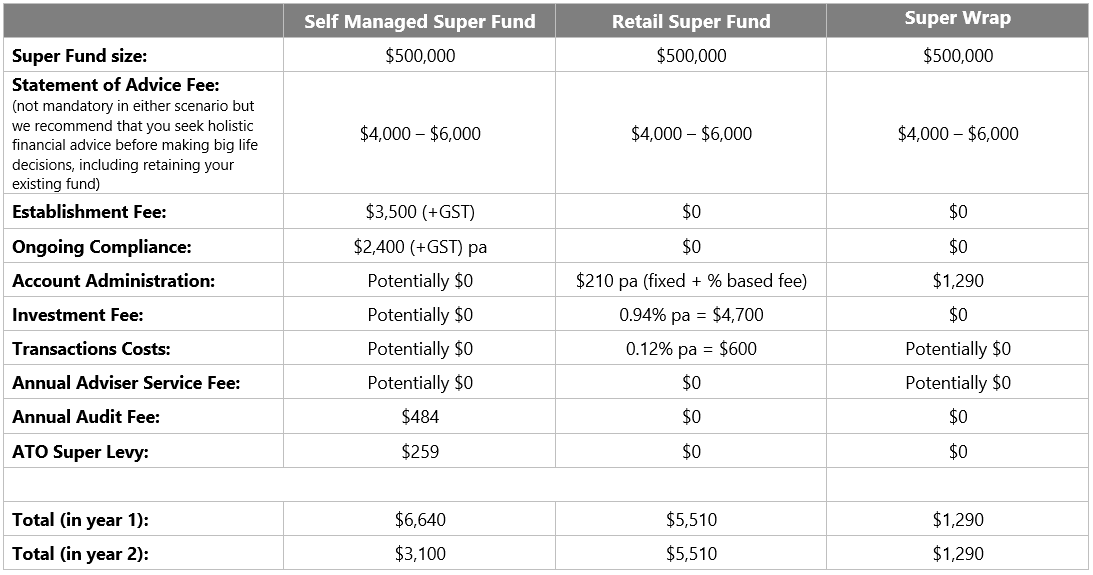

See the table below for a side-by-side comparison of approximate costs of a SMSF to that of a super fund you may have through your employer.

How much super do I need to set up a SMSF?

Some new media stories suggest you need at least $200,000 (or even higher) to make it cost effective to have a SMSF. We disagree. A SMSF is your family wealth creation vehicle. Even if you have as little as $100,000 in super right now, it may make sense to establish a SMSF and then set up life insurance (owned by the SMSF) on SMSF members while they are still fit and healthy. Also, in many situations using a SMSF can give you much better estate planning options.

As an example, if you have $100,000 in super and purchase a property (using a borrowing arrangement) valued at $400,000, then you would have a SMSF with $400,000 in gross assets. Assuming a capital growth rate of 5%, you would generally expect the larger amount of $400,000 growing would provide a better outcome than the smaller amount of $100,000 growing. This is why many people consider a borrowing arrangement for a SMSF.

What investments can I make in a SMSF?

Typical investments include direct shares, managed funds, ETFs, cash, term deposits, and property. There are specific rules about what you can invest in, so it’s important you seek our advice before you make any decisions.

Similar Alternative

If you are looking to have control of your investments but are not sure that you can justify the SMSF compliance fees, then a ‘super wrap’ option might be a suitable option for you. A super wrap provides you with the flexibility to select your own investments such as direct shares, managed funds, ETFs, cash, term deposits, and property funds but does not come with set up and ongoing compliance costs. You will not be able to purchase direct properties with this option, but if that is not your objective then you may wish to seek advice on this style of fund.

Obligation-free Superannuation Consultation – Book now!

To assist you to make an informed decision, contact us on 03 9088 4777 for an obligation-free 30-minute consultation. We can clearly explain, using our exclusive SMSF Comparison Report, the benefits of a SMSF and whether or not a SMSF is the right thing for you.

Don’t delay. The sooner you get started with the right advice, the sooner you will grow your assets to have a better financial future!

A comparison of an SMSF to a sample retail super fund that you may have been put into by your employer

Note: The fees are similar for setup and the first year, though the longer-term is where an SMSF may be more cost-effective than standard retail funds.