Month in Review - May 2021

Australian equities

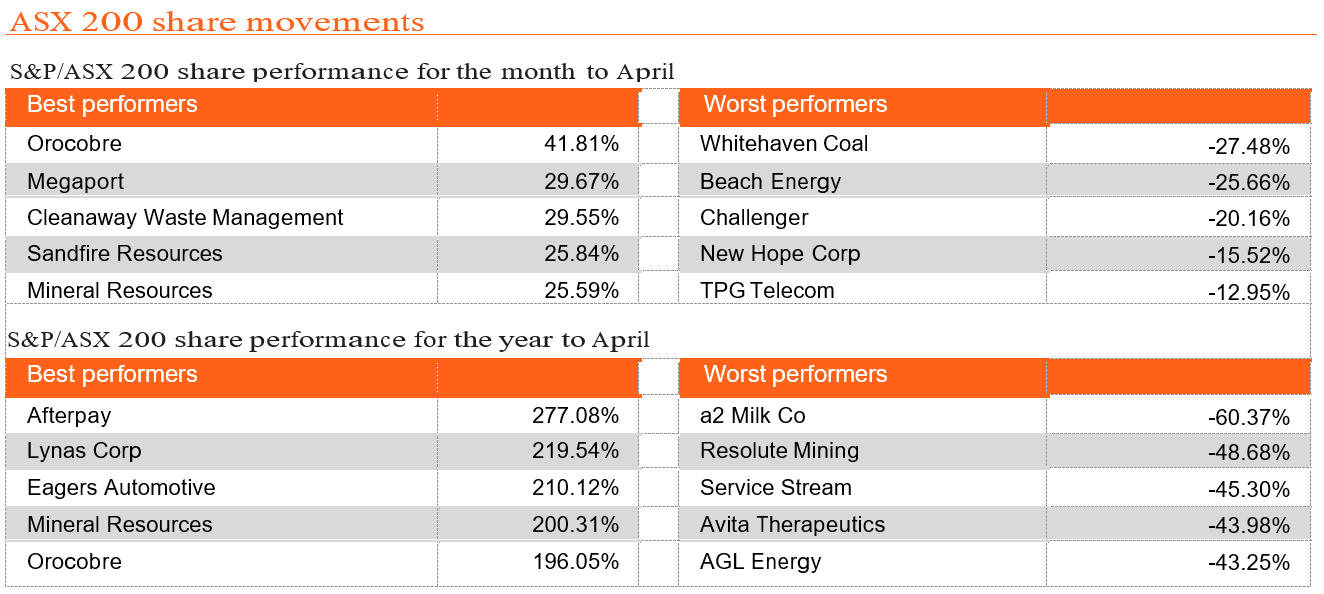

The rotation out of growth and into value sectors has been the key theme through 2021 as the economic recovery materialises, underpinned by a lower unemployment rate. Unless some unforeseen tail risk event occurs, it is expected that business and consumer confidence will rise, providing a clear indication of ‘normal’ conditions returning in the not-too-distant future. In recent stock related news, JB Hi-Fi reported 3Q21 total sales growth of 10.4% in Australia, 16.0% in New Zealand, and 5.8% in The Good Guys. Sales growth slowed in February and March, but the company noted that it started to cycle elevated sales growth from mid-March.

Afterpay reported 3Q21 underlying sales growth of 104% on the prior corresponding period, reflecting strong operating performance across all regions. The US was the highlight, becoming the first region to record more than $1 billion in underlying sales in a single month. Given the US market is now its largest contributor, Afterpay is currently engaging external advisors to explore options for a dual listing in the US. Woolworths provided its 3Q21 sales results, with group sales up 0.4% on the prior corresponding period.

Global equities

The broadening of the recovery in equities globally would suggest that the market anticipates a successful global inoculation drive and a potential reopening of borders. Valuations have moderated through the start of 2021 but remain at elevated levels, while sources of yield across both equities and fixed income remain constrained. The US S&P 500 rose 3.5% over April as optimism about corporate earnings offset concerns regarding rising Covid-19 infections. Facebook reported better than expected 1Q21 results, with revenue jumping 48% on the prior corresponding period to US$26.17 billion, driven by a 30% year-on-year increase in the average price per ad and a 12% increase in the number of ads delivered. Alphabet (Google) also beat the market’s expectations, reporting a rise in revenue of 34% to US$55.31 billion, boosted by a surge in advertising revenues.

The rise in European equities and optimistic economic data came despite a sluggish vaccine rollout and fears of a third wave of the virus across much of the eurozone, sparking tighter restrictions. Developed market shares rose 3.2% in April while emerging markets were softer, rising 1.1% in Australian dollar terms, but are still outperforming developed markets over 12 months.

Property

Australian listed property had a positive month but struggled compared to other sectors as major retail REITs Vicinity Centres (-4.2%) and Scentre Group (- 3.6%) dragged on the index. Charter Hall (+8.7%) led the pack in April, advising that it expects post-tax operating earnings per security to increase more than 57 cents, or 6% compared to FY20, noting that there is no material change to current trading conditions. Charter Hall's $1.5 billion office development on Collins Street in Melbourne's CBD will be Amazon's new Victorian home as the company expands its Australian presence.

Unibail-Rodamco-Westfield provided a 1Q21 update, with Covid-19 restrictions continuing to impact centres. Proportionate Gross Rental Income (GRI) fell 33.4% in the quarter with 42 days of closures versus 13 days in the prior period. Australia’s residential housing market was in focus again given the pace of house price rises, especially in Sydney and Melbourne. March house prices rose 2.8% month-over-month across Australia’s eight capital cities, and February building approvals were up a dramatic 21.6% month-on-month, supported by the HomeBuilder scheme. In the US, February’s S&P/Case-Shiller Home Price Index posted a 1.2% rise, with year-on-year growth in the index coming in ahead of expectations at 11.9%.

Fixed income

Sovereign bond yields steadied in April after pushing higher earlier in the year due to the positive news on vaccines and the additional fiscal stimulus announced in the US. The Australian sovereign yield curve has steepened since the end of 2020, reflected in the spread between the 10-year and 2-year government bond yields, which has risen from 90 basis points at the end of December to 158 basis points at the end of April. While a rise in yields is potentially a welcome sign for economic conditions ahead, the inverse is that they also represent higher borrowing costs for market participants such as corporations and governments. While the RBA has noted the rise in the ‘long end’ of the yield curve, their announcements have indicated a firm stance in relation to the official cash rate remaining at its current level until a sustained rise in inflation. The RBA has briefly acknowledged a temporary rise in inflation “due to reversals in some Covid-19 related price reductions”, however they note that “underlying inflation is expected to remain below 2 percent over the next few years”. Other markets—including the US, UK, and Europe—have seen similar yield curve steepening over 2021. The US Federal Reserve has also acknowledged a potential temporary rise in US inflation and a continued willingness to tolerate overshoots of their target.

Economic News

Australia

Australia had one of the most important federal budgets in history with the government taking advantage of record low interest rates to plug the deficit following the mass stimulus deployed during the pandemic. Treasurer Frydenberg said Australia can grow its economy while maintaining “a steady and declining ratio of debt to GDP over the medium term as we continue to move towards balancing the budget.” Treasury’s projections are that nominal economic growth will exceed the nominal interest rate for at least the next decade. The Reserve Bank of Australia left the cash rate on hold at 0.1% ahead of the May budget, noting that the recovery has been stronger than expected and is forecast to continue. The Markit Composite PMI surprised in April, improving 3.3 points to 58.8 (55.0 expected), driven by sustained increases in manufacturing output and services activity. Retail sales rose 1.3% in March, reversing from a 0.8% drop in February and beating expectations of a 1.0% increase amid a reopening of state borders and an improvement in consumer confidence. Prime Minister Morrison said Australia’s borders will only reopen when it is safe to do so. Morrison clarified that the government is not pursuing an ‘elimination’ strategy and that some cases are to be expected as Australians return home from overseas.

Australia’s manufacturing sector continued to expand in April, with the AIG Manufacturing PMI rising 1.8 points from 59.9 to 61.7, hitting its third-highest ever reading as the sector bounced back from the depths of the pandemic. All six manufacturing sectors and all seven activity indicators were in expansion, while capacity utilisation index hit a record high (indicating that employment and investment may need to step up in order to facilitate further growth from here).

The Westpac-Melbourne Institute Index of Consumer Sentiment rose 7.0 points in April to 118.8, reaching its highest level since August 2010 when the post-GFC rebound and mining boom were in full swing. Given the survey was conducted in the week following the unwinding of the JobKeeper program, the result suggests that consumers see the economic recovery as sustainable, thanks in large part to growth in employment.

Australia recorded a trade surplus of $5,574 million in March, down $2,021 million on the previous month and missing against the expected $800 million. Exports of non-rural good rose $156 million while rural goods exports fell $28 million, including a fall of $315 million in Cereal grains and cereal preparations. Iron ore prices hit US$200 per tonne in early May as Chinese steel mills rushed to lock in supply in the event that trade restrictions are imposed by Chinese authorities.

Global

Global Covid-19 cases continue to rise with over 150 million cases reported at the start of May, but the race is now on to vaccinate key demographics. The International Monetary Fund revised its projections for GDP growth upwards, with the US expected to grow by 6.4% in 2021 and China by 8.4% over the same period.

The United States has fully vaccinated more than 100 million people—including two thirds of all seniors— against the Covid-19 virus, according to the Centres for Disease Control and Prevention, providing further reassurance to markets that the worst of the pandemic is over. However, while confidence measures point to greater optimism, other economic data points to a recovery that is less emphatic than expected.

April’s payroll report came in vastly below expectations (266,000 versus the Dow Jones estimate of 1 million), although the response from markets was relatively muted. The ISM Manufacturing Index came in surprisingly weak in April, down from 64.7 to 60.7 (65.0 expected) as shortages in inputs constrained production. Durable goods orders disappointed in March, growing at just 0.5% month-on-month, below expectations of 2.5%. The result was weighed down by orders for transport equipment which fell 1.7%, with durable goods orders ex-transport printing in line with expectations at 1.6% month-on-month. However, Q1 GDP growth of 6.4% came in above expectations of 6.1% and lifted on the 4.3% expansion in the previous three- month period. Personal consumption was the key driver of the result, lifting 10.7%, while a fall in inventories held back growth.

The Covid-19 situation in Europe is improving as reported cases decline and countries push ahead with vaccine rollouts. According to the World Health Organisation, 5.5% of the European population have contracted Covid-19, while 7.0% have been fully vaccinated—a number which is expected to grow rapidly in coming months.

Economic data has generally been better than expected in recent months, but the eurozone as a whole suffered a decline in GDP (-0.6%, slightly better than the -0.8% expected) in Q1 2021 as the pandemic continued to bite in some regions. The Markit Composite PMI came in above expectations in April, rising from 53.2 in March to 53.7, with both the manufacturing and services PMIs printing ahead of expectations at 63.3 and 50.3, respectively. April’s consumer confidence printed in line with expectations at -8.1, while economic sentiment surged to 110.3 ahead of expectations of 102.2, where improvement was seen across all sectors.

The European Central Bank left its policy rate unchanged at 0.00% during its April meeting, as officials took a patient approach following last month’s decision to conduct emergency bond purchases at a significantly higher pace over 2Q21. The eurozone’s year-on-year inflation rate rose from 1.3% to 1.6% in April, as expected, while core inflation fell from 0.9% to 0.8%.

India has been devastated by a surge in Covid-19 infections, with over 20 million confirmed cases in early May. A number of states have been forced into lockdown as hospitals struggle to provide beds and oxygen, while Prime Minister Modi urged all citizens to get vaccinated to help control the wave. The Covid-19 impact will likely set back India’s economic recovery, but it is still possible that the country could see double- digit GDP growth over 2021 once the vaccine drive intensifies and infections come under control.

China has made deep inroads with its own vaccination program, which has so far inoculated over 240 million people, predominately with the Chinese-developed Sinopharm and Sinovac vaccines. The World Health Organisation is considering the Chinese vaccines for emergency use, which could mean wider distribution through the Covid-19 Vaccines Global Access (COVAX) initiative.

China’s Q1 GDP increased 0.6%, less than the expected 1.5% growth, however the yearly growth rate increased to 18.3%, marking the highest annual growth rate since the data began to be issued in 1992. March industrial production rose less than expected, with the year-on- year rate coming in at 14.1% (17.2% expected), and retail sales grew to a 34.2% yearly rate in March (28.0% expected). April’s NBS Manufacturing PMI slipped to 51.1, down from 51.9 in March and missing expectations of 51.7.

Commodities

Oil prices moved higher through April, driven by the economic recovery, strong economic data from China, and successful vaccine rollouts in the US and Europe, supported by bullish speculative positioning. The Brent spot price rose 6.6% to US$67.7 per barrel in April and the WTI spot price rose 7.8% to US$63.5 per barrel.

Base metals rallied over April, with gains in Tin (+13.0%), Copper (+11.8%), Nickel (+10.0%), Lead (+9.0%), Aluminium (+8.4%) and Zinc (+3.8%). The gold price rose 3.3% to US$1,769 per ounce.

Currencies

The Australian dollar continued to strengthen in April, rising 2.3% against the US dollar and lifting 0.8% in trade-weighted terms, helped by an easing in US Treasury yields over the month. The weaker-than- expected US jobs report has raised expectations that the US Fed will keep rates on hold for longer, although the RBA has also indicated that it will remain highly accommodative until 2024.