Month in Review - April 2021

Australian equities

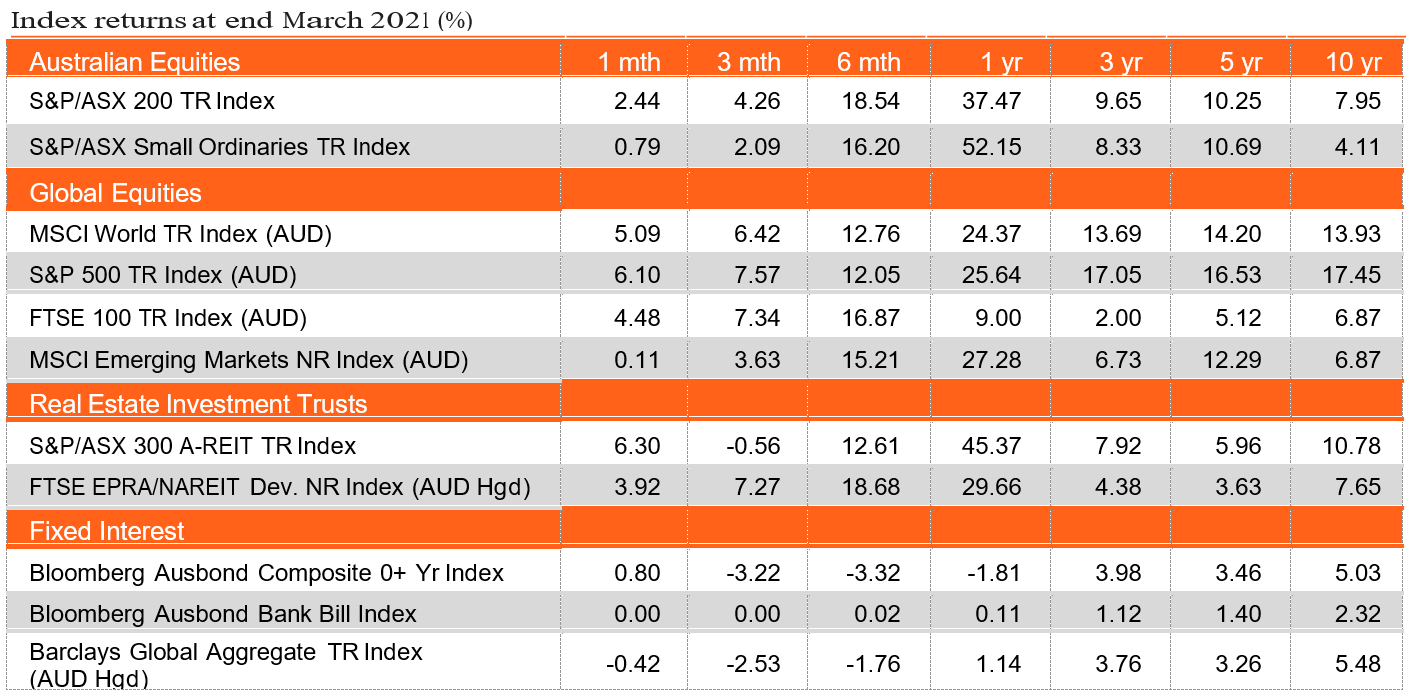

Australian shares extended their rally through March, gaining 2.4%, but could not keep pace with global markets, which have been buoyed by the vaccine story. In Australia, very low levels of community transmission and the rollout of the vaccine program have delivered a boost to optimism, particularly for sectors directly linked to the re-opening of the economy such as consumer discretionary and industrials. Meanwhile, companies that benefited from Covid-19 (e.g. Coles and JB Hi-Fi) will have higher comparable sales to meet in upcoming result periods.

In stock-related news, Macquarie Infrastructure Group and Aware Super launched a bid for Vocus and the market received further details on Telstra’s proposal to restructure its business model. AGL announced plans to create two energy businesses focused on executing distinct strategies via a structural separation. The ‘New AGL’ will deliver electricity, gas, internet and mobile services to more than 30% of Australian households. Sydney Airport released traffic performance numbers for February showing total passenger traffic down 79.8% on the prior corresponding period. China confirmed it will place a tariff of 175.6% on Australian wine exports in bottles and containers holding less than two litres. Treasury Wine Estates made plans last year to divert most of its high-end wine from China to other Asian markets.

Global equities

Following the March 2020 low, the subsequent rebound in global markets was initially fuelled by growth companies in technology and healthcare that performed well as the pandemic swept across the globe and strict lockdown measures were implemented in most countries. As vaccines continue to roll out globally, the rebound has shifted to more cyclical areas of the market that are expected to perform strongly as the world returns to ‘normal’. In the US, the style rotation has been most strongly depicted in the performance disparity between the ‘old economy’ Dow Jones Industrial Index, which rose 8.3% in the March quarter, and the ‘new economy’ NASDAQ Composite Index, which rose 1.8%. The rotation is being aided by rising bond yields, which challenge the lofty valuations that have been assigned to growth assets, especially in the technology sector.

Chinese shares remain under pressure as markets express concerns around potential policy normalisation as the economy recovers from the pandemic. In addition, uncertainty surrounding potential regulation for some industries and ongoing geopolitical tensions continue to dampen investor sentiment in the region. Emerging markets were weak in March, rising only 0.1% in Australian dollar terms, but have outperformed developed market shares over the past 12 months.

Property

Debate in global property markets has turned to office markets and how the pandemic may have changed demand for office space on a permanent basis. While the return to work in CBDs is progressive, there is a growing realisation that more flexibility to include working from home arrangements is both possible and desired. As companies plan ahead and leases come to an end, there is already demand for core space plus an option for a flexible amount. After selling off heavily in early 2020, retail property REITs have had bursts of recovery during the last six months as investors react to a vaccine-led recovery. Food and necessity-based shopping centres have continued to trade well and remain in demand by investors. Shopping strips and malls with a high proportion of discretionary spending have been hard hit, and owners face a period of readjustment in tenant mix and rentals.

In Australia, the residential housing market has been a surprising area of strength. The combination of a ‘lower for longer’ cash rate and a shortage of supply in the secondary market has seen prices escalate quickly, although this may seem at odds with the underlying economic conditions in Australia where JobKeeper and other support have now ended and banks require mortgages to be serviced after a brief hiatus for those in need.

Fixed income

Once again, the bond market is proving a critical barometer of the market’s mood. The US 10-year Treasury yield has risen from around 0.9% at the end of 2020 to over 1.7% at the end of March 2021, which is consistent with the ongoing improvement in economic data. However, the rise in yields also reflects the market’s concern about inflation, which has been exacerbated by the speed and scale of stimulus measures and questions around the ability of governments and central banks to withdraw or scale back these measures responsively.

Demand for government bonds has proved resilient despite the flood of supply, although prices have been volatile and investors are watching how bond auctions play out following the lapse of bank regulatory exemptions that have done much to buoy the bond market since the start of the pandemic. In Australia, the RBA remains committed to the 3-year government bond yield target of 0.10%. The initial $100 billion government bond purchase program will finish in April and the second $100 billion program will commence. In the short term, the RBA expects CPI inflation to rise due to the reversal of some Covid-related price reductions, but beyond this anticipates that underlying inflation will remain below 2.0% in coming years.

Economic News

Australia

With no community transmitted Covid-19 cases, the Queensland government ended the snap three-day Brisbane lockdown, but maintained some mask wearing and social distancing measures. Whether tight elimination lockdowns or more moderate versions will be needed as Australians get vaccinated is still up for debate. The Australian government announced a preference for the Pfizer vaccine for Australians under 50 amid concerns of rare blood clots potentially linked to the AstraZeneca vaccine. In economic news, February employment numbers surged by 88,700, accentuated by the fact that the entire increase came from full-time jobs with employment now above the pre-pandemic level.

As widely expected, the RBA maintained its current accommodative monetary policy settings at its April meeting. The board noted that it remains committed to the 3-year government bond yield target of 0.10% but will consider whether it retains the April 2024 bond or shift to the next maturity date. Preliminary building permits jumped 21.6% in February, soundly beating expectations of 5.0% and reversing from a 19.4% slump in January. New Zealand announced plans to open a two-way, quarantine-free trans-Tasman travel bubble, with the option to continue, pause or suspend if a case is detected in Australia.

Australia’s manufacturing sector continued to expand in March, with the AIG Manufacturing PMI rising 1.1 points from 58.8 to 59.9. All six manufacturing sectors reported positive trading conditions during March, with especially buoyant conditions reported by manufacturers in machinery and equipment and textiles clothing, footwear, paper & printing products. Separately, the latest Markit survey showed the seasonally adjusted manufacturing PMI continued to expand, albeit at a slightly slower pace of 56.8, down from 56.9.

The Westpac-Melbourne Institute Index of Consumer Sentiment rose 2.7 points in March to 111.8 and is now just 0.2 points below the December level, which was a ten-year high. Key contributors to sentiment have been improving economic conditions on the back of global and local efforts to distribute vaccines, and tightening in labour market conditions following a spike in unemployment during the pandemic. Support from stimulatory government policies have also contributed to the sustained lift.

Retail turnover was soft in February, falling 0.8%, but showed a 9.1% increase through the year, demonstrating the importance of consumers in driving the recovery. Department stores saw the strongest rise over the month, adding 2.2%, while food retailing fell 3.0%. Sales are expected to soften as JobKeeper and JobSeeker support concludes, while the recovery will continue to be uneven, with travel retailers and SME’s in CBD locations bearing the brunt of the pandemic fallout.

Global

Global Covid-19 cases continue to rise with over 130 million cases reported in early April, but the vaccine narrative is still propelling the economic recovery. The rollout has been slower than many had hoped, but the US and UK are now making strong progress. The International Monetary Fund is forecasting the world economy to expand 6.0% in 2021, up from the 5.5% it had forecast in January.

The US economy continues its upward trajectory with recent data pointing to an upswing in activity and an improvement in confidence as the vaccine rollout increases pace. More than 100 million people have received at least one coronavirus vaccine dose, and over 1 million doses were administered on a single day. The IMF expects US GDP to grow by 6.4% in 2021, an upgrade of 1.3 percentage points, driven in large part by the Biden administration’s $1.9 trillion stimulus.

The manufacturing index rose to 59.0 as expected, while the services index surprised to the upside at 60.0 (above the expected 59.1). The ISM non-manufacturing PMI continued to strengthen in March, lifting from 55.3 to 63.7 and easily surpassing expectations of 59.0. The reading pointed to the strongest growth in services activity on record as the easing of coronavirus-related restrictions released pent-up demand for many services.

Non-farm payrolls for March came in strongly at 916k, beating expectations of 647k, while consumer confidence surged 19.3 points in March to 109.7, beating expectations of 96.9. The Federal Reserve maintained its accommodative policy stance at its March meeting, as widely expected. Fed Chair Jerome Powell stated that the unevenness in the economic recovery will see monetary policy remain accommodative for some time.

Europe’s battle against the coronavirus took a backward step as France and Italy were forced to impose nationwide lockdowns ahead of the Easter weekend following a surge in cases. France’s President Macron announced that the lockdown rules currently in operation in 19 French departments, including the Paris region, will be extended to the rest of the country and will remain in place for at least four weeks. German Chancellor Angela Merkel said she is in favour of a “short national lockdown” as the country struggles to bring case numbers under control with a surge in the British variant.

Meanwhile the UK remains on a steady path out of its three-month lockdown as the government considers a ‘vaccine passport’ to allow travellers proof of their inoculation, although equitable concerns have been raised for those unable to access vaccines. UK GDP expanded 1.3% in the fourth quarter, surpassing expectations of 1.0%, while the yearly rate improved 1.2% to -7.3% (-7.8% expected). China is ramping up its vaccine diplomacy, with Chinese-made vaccines being used to inoculate millions of people in dozens of countries around the world. China is still lagging the US in the number of people vaccinated, prompting the Chinese Centre for Disease Prevention and Control to up its target for the number of people injected to 560 million, or 40% of its population, by the end of June.

China's economy returned to pre-pandemic levels last year and is projected by the IMF to grow by a further 8.4% in 2021, in contrast to most other major economies, which will not return to their pre-pandemic size until 2023 at the earliest. In terms of recent economic data, retail sales surged 33.8% year-on-year in the January- February period, above expectations of 32.0%, as sales cycled last year’s lows due to the coronavirus shutdown.

Japan’s economic recovery has been stymied by a slow vaccine rollout and trepidation among consumers as daily cases continue to climb. The key focus for the government is the vaccination of people aged 65 and over, of which there are around 36 million. Once a critical mass within this demographic receive the vaccine, the government expects personal consumption to get a significant boost.

India reported more than 100,000 daily Covid-19 cases in early April, a grim measure achieved only by the United States and Brazil. However, despite the economic pain wrought by the pandemic, which caused a record 8.0% drop in GDP over 2020, the IMF forecasts a 12.5% rebound in 2021, and further growth of 6.9% in 2022. India—along with the US, China, Indonesia and South Korea—will be among the only major economies to exceed pre-pandemic GDP levels by the end of 2021.

Commodities

Oil prices softened over March as ongoing lockdowns and delays to vaccine rollouts counteracted the recovery optimism. The Brent spot price fell 3.6% to US$63.5 per barrel and the WTI spot price fell 3.8% to US$59.2 per barrel. Oil prices jumped late in March amid concerns global supplies of crude and refined products could be disrupted for weeks, as workers try to dislodge a giant container ship blocking the Suez Canal.

Base metals were mostly down in March, with falls in Nickel (-13.5%), Lead (-3.8%), Copper (-3.2%) and Tin (-1.1%), and gains in Aluminium (+2.7%) and Zinc (+0.9%). The gold price fell 1.3% to US $1,712 per ounce.

Currencies

The Australian dollar was under pressure in March, softening 2.9% against the US dollar to end the month at around USD 0.76. Rising Treasury yields in the US have been supportive of the greenback, while the risk-on sentiment has also supported ‘commodity currencies’ like the Australian dollar in recent months. Both the RBA and US Federal Reserve remain highly accommodative.