Month in Review - March 2021

Australian equities

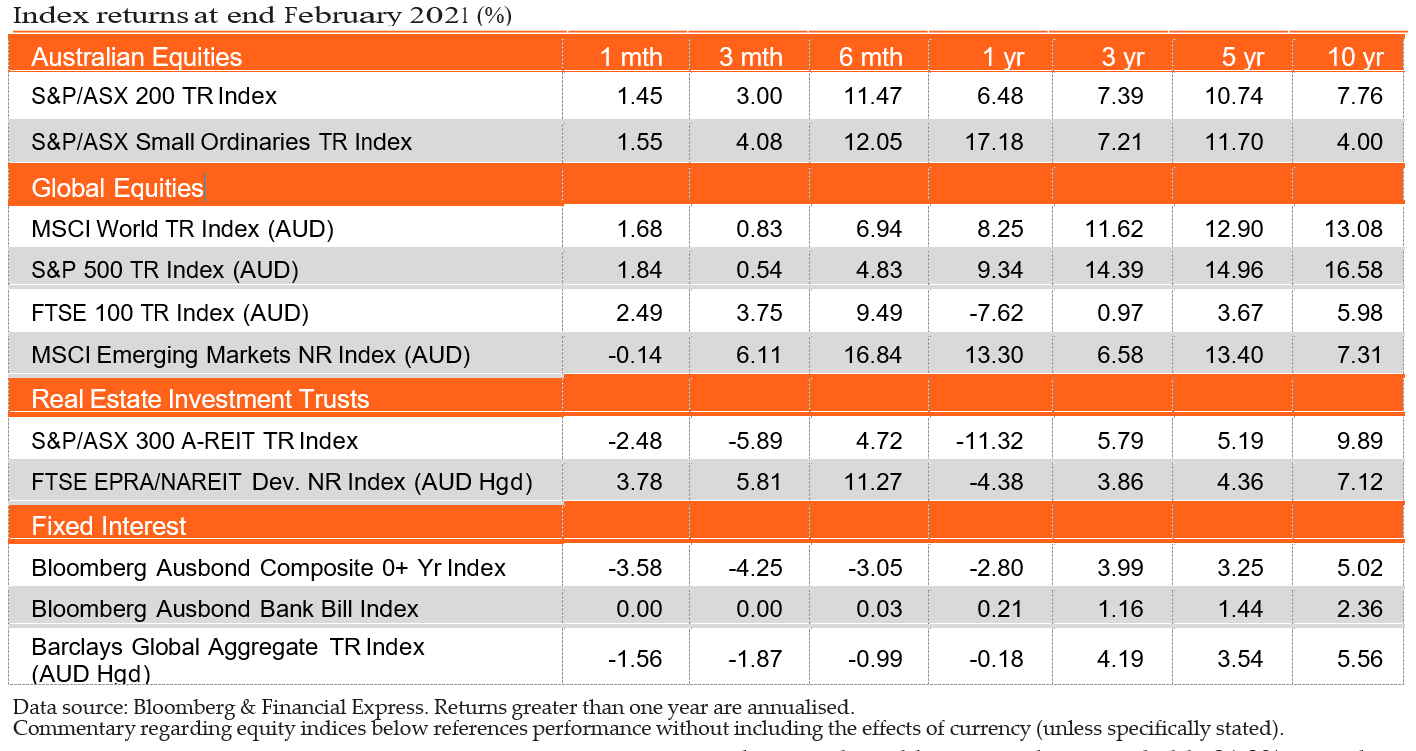

Earnings season revealed a corporate environment still impacted by Covid-19, with earnings down in aggregate and companies opting to hold more cash, although the lift in dividends has been a key positive development for Australian investors. Cyclical shares have benefitted from greater confidence, spurred on by the vaccine rollout and the return to more normal economic conditions. After falling out of favour during the pandemic, major banks have reported dividend increases and rising payout ratios. The sticking point has been the recent rise in yields, which has had a significant impact on growth sectors such as IT, although fundamentals remain largely unchanged.

Recent earnings releases include Woolworths, which reported 1H21 sales growth of 11% on the prior corresponding period. Australian Food total sales grew 11%, benefitting from Covid-19 related demand, but sales moderated over 2Q21 as pandemic restrictions eased. CSL’s interim 1H21 results showed exceptionally strong performance from its influenza vaccine business Seqirus, which reported a 38% jump in revenue on the prior corresponding period, compensating for Covid-19 related headwinds in plasma collection. A2 Milk reported a 16% fall in revenue and 32% decline in EBITDA driven by disruptions in the daigou and CBEC distribution channels.

Global equities

Global equity markets had a positive month in February despite rising yields spooking investors and raising the prospect of inflation. The S&P 500 Index rose 2.8% over the month and has gained a remarkable 31.3% over the past 12 months since the end of February 2020, before the world entered lockdown. Reaching the end of reporting season, S&P 500 companies reported positive earnings growth in aggregate for the first time since Q4 2019. However, only five out of eleven sectors delivered positive growth, with earnings from technology, materials and financials doing the heavy lifting.

Value shares continued their rally through the start of 2021, but performance has not been uniform, with cyclical stocks benefitting strongly from renewed confidence while value with a quality bias has struggled. European shares joined in the global rally in February as vaccine progress and stimulus measures pushed the Stoxx 600 Index higher and just shy of its February 2020 all-time high. Value and cyclical sectors such as banks, commodities producers and travel companies have been leading the reflation trade-driven advance. In Asian markets, Japan’s Nikkei 225 Index rose 4.8%, Hong Kong’s Hang Seng Index rose 2.5%, and China’s CSI 300 Index fell 0.3%.

Property

Australian listed property continued to trend down through February as Covid-related headwinds— including the longer-term consequences of how occupiers utilise property going forward—were exacerbated by the rise in yields. After bearing the brunt of lockdown measures, shopping centres were in the green over February, with gains from Vicinity Centres (+6.8%) and Scentre Group (+5.5%). National Storage REIT released its 1H21 results, with underlying earnings growing 14% and storage revenue rising 12%, boosted by occupancy and rate growth. Service station and convenience store owner Waypoint REIT (formerly Viva Energy) released its FY20 results, announcing a 7.0% rise in total income and a 6.1% rise in distributable earnings.

CoreLogic data showed Australian house prices rose 2.1% in February—their fastest rate in 17 years— with growth in every capital city thanks to improving economic conditions. According to the ABS the value of new housing loans rose 10.5% in January and is up 76% since its May 2020 low. In the US REIT market, the post-vaccine sector rotation has been the prevailing theme as investors favour reopening-sensitive sectors such as retail, hotels and offices over ‘essential’ sectors like housing, industrial and technology.

Fixed income

The main story through February was the continued rise in longer-dated yields and a steepening of the yield curve, with implications for equity market valuations and central bank policy. For context, the spread between the Australian 10-year and 2-year yields was 177 basis points at the end of February 2021 versus 28 basis points at the same time in 2020. While QE and lower cash rates have done the job of flattening the short end of the yield curve, the long end has proved more stubborn.

The RBA minutes for the February meeting noted the risk of ceasing the bond purchase program when the market widely anticipated an extension, stating it could lead to “unwelcome significant upward pressure on the exchange rate”. Regarding its yield curve control policy, the RBA will “consider whether to shift the focus of the yield curve target from the April 2024 bond to the November 2024 bond” later this year. In the US, Treasury yields rose from 1.11% to 1.44% over February and continued to push higher in early March. Spreads on municipal bond yields have narrowed notably, reflecting expectations of additional fiscal stimulus and aid to state and local governments, while spreads on corporate bond yields over Treasury yields have also narrowed.

ASX 200 share movement

Economic News

Australia

The rollout of the AstraZeneca vaccine is set to begin in March as the first 300,000 doses landed in Sydney, with 1.2 million more doses due shortly from Europe before Australian partner, CSL, begins production of 50 million doses. The federal government said Australian health professionals will soon be delivering over 500,000 vaccinations a week, with general practitioners set to assist in the Covid-19 vaccine rollout in coming weeks. Health Minister Greg Hunt confirmed that Australia will keep its international borders shut for at least another three months with over 40,000 Australians still stuck overseas. GDP grew 3.1% in the December quarter, taking the yearly rate from -3.8% to -1.1%. The result marked the second straight strong quarter of growth as the economy continues to recover from Covid-19 led restrictions helped by high levels of monetary and fiscal stimulus.

Household consumption rose 4.3% in the quarter, after posting a record 7.9% gain in the previous quarter, while government spending rose for the tenth straight quarter, up 0.8%. Employment rose 29,100 in January, falling short of the expected 40,000 new jobs, however the unemployment rate fell to 6.4%, below expectations of 6.5%, marking the lowest rate since April 2020 as the economy emerges from the pandemic shocks.

The AiG Manufacturing PMI rose 3.5 points in February to 58.8, marking the strongest the index has been since March 2018. According to AiG, Australia’s manufacturers lifted production and employment in February as sales recovered a large share of the ground lost in 2020. The production, sales, employment and new orders indices all improved from the December and January period, with the new orders index up 5.3 points to 59.9, indicating further strong production in the coming months.

Sentiment remains strong with the Westpac-MI Consumer Sentiment Index lifting to 109.1 in February from 107.0 in January. With the JobKeeper program set to be phased out at the end of March, the ability of consumers to look ahead with confidence is critical. The ‘time to buy a dwelling’ index fell 3.1% and is now 8.6% below its peak in November. The decline in recent months suggests that increases in house prices may already be starting to weigh on the purchasing sentiment.

Retail sales expanded 0.6% in January, missing expectations of 2.0% growth, however, it was an improvement on the 4.0% decline recorded in December, aided by easing COVID-19 restrictions around some parts of the country. Food retailing led the rises, while there were falls in clothing, footwear and personal accessory retailing, household goods retailing, and department stores, which all saw impacts from interrupted trade in Queensland.

Global

Covid-19 cases continue to build globally, with around 114 million reported cases at the start of March, but the vaccine narrative is propelling the economic recovery forward, even as some regions face logistical headwinds. Fiscal and monetary policy remain extremely accommodative and are helping households and businesses through the final stages.

President Biden marked the distribution of 50 million coronavirus vaccine doses since taking office, reaching the halfway mark of the administration’s goal of 100 million inoculations within the first 100 days. An independent advisory panel voted to recommend Johnson & Johnson’s Covid-19 vaccine for emergency use, which would make a third vaccine available to Americans. A stellar jobs report for February showed the labour market recovery has been even stronger than expected.

US nonfarm payrolls rose by 379,000, well ahead of the consensus 182,000, while January’s reading was revised upwards from 49,000 to 166,000. December quarter GDP was revised up to an annualised 4.1%, while durable goods orders in January surged 3.4% month-on- month, surpassing expectations of 1.1%, boosted by a 7.8% rise in orders for transportation.

The PMI composite index came in well above expectations in February at 59.5 (58.8 expected), up from 58.7 in January, while the services index also surprised to the upside at 59.8 (58.9 expected). Retail sales jumped 5.3% in January, beating expectations of 1.1%, marking the largest increase since June 2020 as new stimulus checks helped to boost consumer spending. Personal income rose 10.0% in January (9.5% expected) and personal spending also rose broadly as expected, gaining 2.4%.

Following strong growth in the third quarter, Europe's economy contracted 0.4% in the December quarter as the pandemic tightened its grip on the continent, while the EU was forced to cut its growth forecast for 2021 from 4.1% to 3.7%. The race to inoculate has been derailed by logistical challenges and shortages. In Germany only 6% of the population has received the first dose, while the German government was forced to reverse its decision not to authorise the AstraZeneca vaccine for people over the age of 65.

Across the channel, over 20 million people in the UK have received their first doses of the vaccine, coinciding with daily case numbers at their lowest since September 2020. Prime minister Johnson announced a four-stage plan to lift restrictions in England, with all restrictions on social conduct to be lifted by June.

Overall, the recovery story remains intact albeit dilated. The economic sentiment index for the eurozone improved from 92.0 to 93.4 in February as the outlook for vaccine rollouts and easing of restrictions bolstered confidence. The IHS Markit Eurozone Manufacturing PMI surprised in February, lifting 2.9 points to 57.7 against expectations of a fall to 54.3. January’s retail sales came in well below expectations, falling 5.9%, while the unemployment rate held steady at 8.1%.

After managing economic growth of only 2.3% in 2020, its weakest in decades, the Chinese government is aiming for a significant rebound in 2021. At the opening of this year’s National People’s Congress, Premier Li Keqiang announced a growth target of over 6.0%, which appears almost modest compared to the IMF’s estimate of 8.1% growth for 2021. The Chinese authorities appear to be focused on the quality of growth, including reform and innovation, rather than pure numbers. China is relying on two domestically developed vaccines and is competing with Russia in conducting ‘vaccine diplomacy’ throughout central Asia, although based on data from Brazil, China’s Sinovac jab showed an efficacy rate of just over 50%, which is well below Pfizer’s 95% efficacy rate.

Japan’s vaccine campaign has stalled due to shortages, with only limited doses of the Pfizer vaccine available until increased supplies can reach Japan from Europe, which is expected to be around May. Japan’s GDP is expected to expand 3.0% in the fourth quarter, down from 5.3% in the previous quarter, while the yearly rate is expected to move lower to 12.8%. Retail sales growth fell from -0.2% to -2.4% year-on-year in January, while preliminary industrial production numbers revealed a rebound of 4.2% in January following the 1.0% contraction in December.

Commodities

Oil prices jumped over February as the economic recovery solidified and boosted by reports that oilfield crews in Texas may need several weeks to resume normal operations after last week’s record freeze. The spot price of WTI crude rose 18.0% to US $61.55 per barrel and Brent rose 19.2% to US $65.86 per barrel. Base metals were stronger in February, with gains in Copper (+15.5%), Tin (+12.7%), Aluminium (+9.0%), Zinc (+8.3%), Nickel (+5.0%) and Lead (+1.4%). The gold price fell 6.1% to US $1,734.04 per ounce.

Currencies

The Australian dollar resumed its upward climb in February, gaining 2.4% against the US dollar to end the month at USD 0.78, boosted by record trade figures. Rising yields, led by the US Treasury market, could represent an obstacle for the Australian dollar moving higher, while the RBA is committed to keeping monetary policy as accommodative as possible, but fundamentals remain robust.