Borrowers: Home loan refinancing (or switching)

Paying off your home loan will most likely be the largest debt that you pay off in your lifetime.

This can reduce the amount of interest you pay, and decrease the life of the loan. In turn, you can free up cash flow sooner and direct it elsewhere, such as saving and investing for the future

One consideration is refinancing (or switching) if you find a more appropriate home loan.

Home loan refinancing

Home loan refinancing occurs when a borrower repays their home loan with one lender (the previous lender) using the proceeds of a new home loan obtained from another (the new lender).

Here is a broad outline of the steps involved in the refinancing process:

“The borrower contacts the new lender and lodges an application with all required documentation.

The new lender considers the documentation and assesses the application.

The new lender conditionally approves the application and sends a letter of offer to the borrower.

The new lender orders a property valuation.

The borrower accepts the offer.

The borrower completes and submits a Discharge Authority Form request with the existing lender.

The existing lender prepares the Discharge of Mortgage form and associated documentation for settlement.

The new lender pays the existing lender the amount owing on the loan. And, the existing lender gives the new lender the certificate of title and Discharge of Mortgage form.

The new lender submits the certificate of title, Discharge of Mortgage form and the new mortgage to the relevant land titles office.”

So, why can refinancing be a key consideration in terms of taking an ongoing proactive approach to paying off your home loan? One reason is that you may save on unnecessary home loan interest.

For context, according to the ACCC’s Home Loan Price Inquiry final report:

“A significant number of borrowers have not switched lenders for several years. As at December 2019, almost half of all variable rate loans were originated at least four years ago. As borrowers’ loans get older, the gap between what they pay and what borrowers with new loans pay widens. For example, as at September 2020:

borrowers with home loans between three and five years old were, on average, paying around 58 basis points above the average interest rate for new loans

borrowers with home loans between five and 10 years old were, on average, paying around 71 basis points above the average interest rate for new loans

borrowers with home loans greater than 10 years old were, on average, paying around 104 basis points above the average interest rate for new loans.”

When considering above, approximately 53% of existing borrowers are unaware of their current interest rate. Furthermore, nearly one-third of existing borrowers wouldn’t consider refinancing unless they were offered an interest rate at least 60 basis points (equivalent to 0.6%) lower than their current one.

This can often come down to financial disengagement, and many existing borrowers presume they probably won’t save much (by way of meaningful savings) through refinancing.

According to recent data from the Reserve Bank of Australia^ on housing lending rates for the month of October 2020 (and taking into consideration all lending institutions and all loans*):

the lending rate for outstanding owner-occupied housing credit was 3.13%

the lending rate for new owner-occupied housing credit was 2.66%.

*Variable-rate, fixed-rate, interest-only, and principal-and-interest housing credit basis.

This is a 47 basis point (equivalent to 0.47%) difference between the lending rates of existing and new borrowers. From a long-term perspective, 47 basis points can add up to meaningful savings.

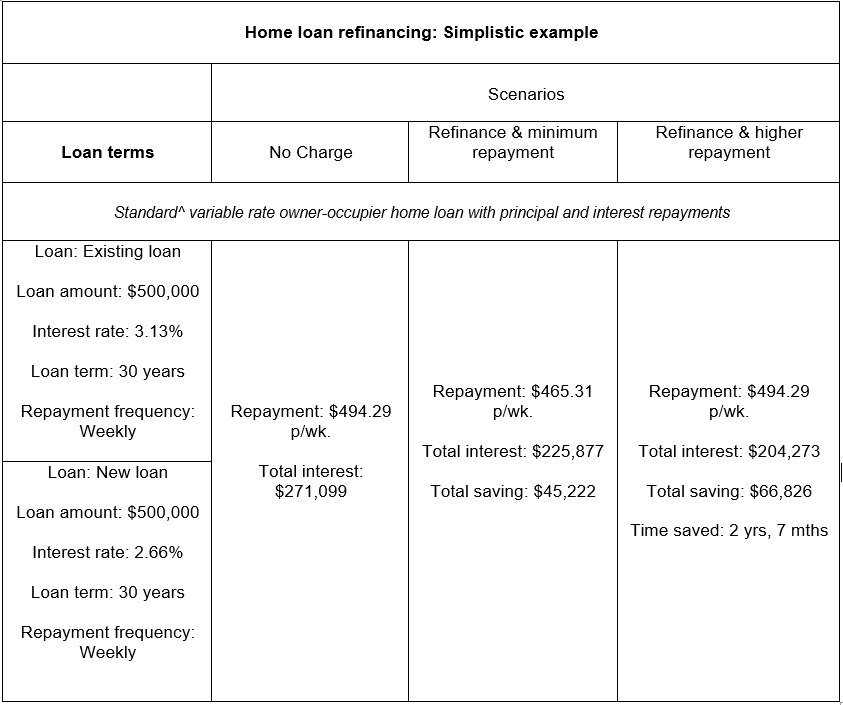

Here is a simplistic example regarding a standard variable rate owner-occupier home loan with principal and interest repayments—and, an existing borrower.

Home loan refinancing: Simplistic example*

*This is a simplistic example—it doesn’t, for example, take into account the effect of potential interest rate movements over time or any refinancing costs that may apply, such as discharge fees, application fees or legal fees.

^Standard home loan products are those supplied with a range of add-on features, such as an offset account.

Moving forward

When it comes to refinancing your home loan, there can be a range of reasons why you may want to change from your existing lender to a new lender including:

If your circumstances have changed, or you've had your home loan for a few years, then refinancing could offer you the chance to take advantage of more flexible features or competitive interest rates.

As it stands, there are over 100 home loan lenders in Australia offering a combined total of nearly 4,000 different home loan products.

Refinancing could also enable you to use your home equity to invest, consolidate debt or access cash to fund expenses such as education costs or home improvements/renovations.

At the end of the day, it’s important to do your homework so you can make an informed decision on whether refinancing is appropriate for you. This can include seeking professional advice.

Lastly, please remember, there may not be a need to refinance. For example, you may have the option of asking your existing lender for a better rate or switching to a cheaper, but still appropriate product with them.

If you have any questions regarding this article, please contact us.