RETIREMENT AND CHANGES TO THE AGE PENSION DEEMING RATES

Financial wellbeing is defined as when you are able to meet expenses and have some money left over, are in control of your finances, and feeling financially secure, now and in the future.

Some of the main factors that can influence your financial wellbeing are as follows:

1. financial capability (your financial knowledge, attitudes, decisions, and behaviours),

2. financial inclusion (your access to appropriate and affordable financial services and products),

3. social capital (your social network that can provide support in times of financial stress),

4. economic resources (your savings, investments, insurances, emergency funds, cashflow and debt management, and income).

In light of the above, financial wellbeing is pertinent, regardless of whether you are working or in retirement.

When it comes to maintaining your financial wellbeing in retirement, it’s important to understand that a certain shift in economic resources often occurs, as you enter this phase of your financial lifecycle.

Namely, a shift from employment income to income derived from a combination of your retirement savings (investments inside and/or outside of super) and any Age Pension entitlements.

Coupled with this comes certain interconnected risks that are specific to retirement, for example:

longevity risk (the potential of living longer than expected, and subsequently outliving your retirement savings),

legislative risk (the potential of changes in social security, taxation, and super legislation by an existing or future government),

inflation risk (the potential of high inflation which increases the cost of living and forces you to spend more of your capital than expected),

investment risk (the potential of lower than expected returns affecting the level of your retirement savings and future income generated),

expenditure risk (the potential of unplanned costs and lump sum expenses in retirement, which reduce your retirement savings and future income levels),

sequencing risk (the potential of negative returns at or near retirement affecting the market value of your retirement savings that can't be recouped due to the minimum pension payment requirements).

Importantly, strategies are often employed to manage these risks, pre and post-retirement, for example:

diversifying your retirement savings,

using the super system to your advantage,

building up your retirement savings to a sufficient level,

investing a portion of your retirement savings in an annuity,

reducing your investment risk upon approaching retirement,

working in some capacity in retirement (e.g. casual or part-time),

utilising the three-bucket (cash, stable, growth) approach in retirement,

reducing the income you draw down (subject to the minimum payment requirements).

However, some risks are harder to manage than others, and in certain circumstances necessitate the intervention by an external party, such as the Government.

For example, in recognition of the impact of the global financial crisis (GFC) on shares (see below table), the Government decided to reduce the minimum payment requirements for certain retirement income streams.

The minimum payment requirements were reduced by:

50% for the 2008-09, 2009-10 and 2010-11 financial years.

25% for the 2011-12 and 2012-13 financial years.

More recently, in recognition of the impact of the current low interest rate environment on cash and fixed interest(see below table), the Government has decided to reduce the deeming rates for the Age Pension.

From 1 July 2019, the deeming rates have been reduced by:

42.86% for the lower deeming rate (from 1.75% to 1.0%), which applies to the first $51,800 of financial assets for a single person (the first $86,200, for a couple).

7.69% for the upper deeming rate (from 3.25% to 3%), which applies to financial assets in excess of $51,800 (in excess of $86,200, for a couple).

Please note: This affects other income-tested payments, such as the Disability Support Pension and Carer Payment, and income support allowances and supplements, such as the Parenting Payment and Newstart.

For context, the Age Pension is a ‘retirement lifestyle safety net’, and it’s received (in part or full^) by those of us that satisfy the relevant age, residency, and income and assets eligibility tests.

The maximum total pension rate (including Pension Supplement and Energy Supplement) differs according to whether you are single (currently $926.20 per fortnight) or a member of a couple (currently $698.10 per fortnight each). However, if a couple is separated due to illness, they are each entitled to the single rate.

Importantly, the rate of payment is calculated under both the income test and the assets test, with the test that results in the lower rate (or nil rate) being applied.

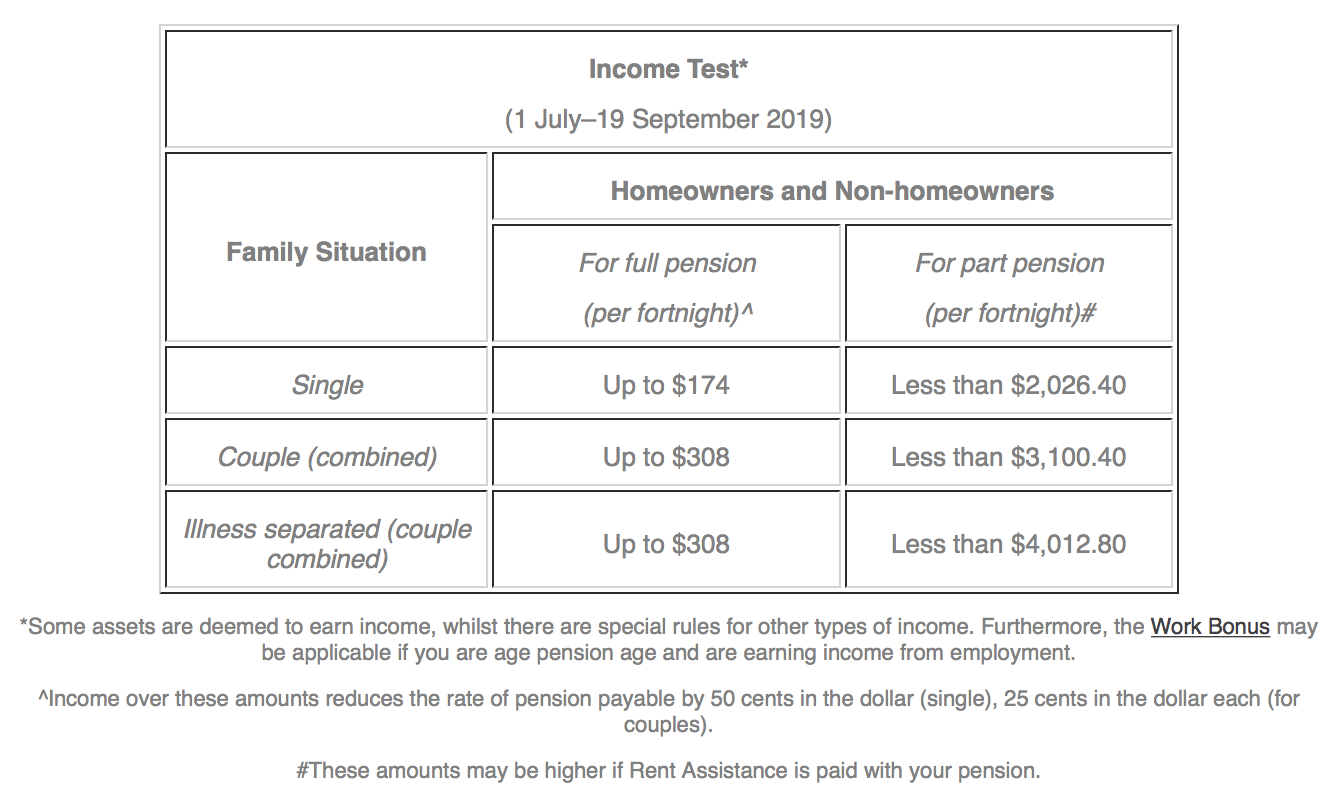

With the income test (see below table), some financial assets are deemed to earn income (regardless of the amount of income they actually earn), for example, savings accounts and term deposits, managed investmentsand listed shares, and some income streams.

Importantly, if financial assets earn a return higher than the deeming rates, then the extra amount is not assessed as income. However, this is not the issue at hand.

As background, in comparison to your accumulation years, you may often find that in your retirement years your retirement savings may be invested with a higher allocation towards income-generating assets.

This is to not only help manage some of the retirement-specific risks listed above, but also help facilitate the provision of income to fund your retirement lifestyle.

Now, when considering the current low interest rate environment, these income-generating assets, such as cash and fixed interest, are earning a return lower than the deeming rates.

For some, this has meant that they have had to make the decision, regarding their retirement savings, to:

reduce their retirement lifestyle by, for example,

drawing down less income (subject to the minimum payment requirements);

maintain their retirement lifestyle by, for example,

accelerating the sell down of their existing capital growth assets for more income;

increasing their asset allocation towards capital growth assets for expected higher returns.

These can be difficult decisions, especially when they can compromise, for example, their retirement lifestyle expectations, retirement savings longevity, and investment risk profile preferences, now and into the future.

Hence the decision by the Government to reduce the deeming rates. The Minister for Families and Social Services stated this will, “benefit about 630,000 age pensioners and almost 350,000 people receiving other payments…up to $40.50 a fortnight for couples, $1053 a year, and $31 a fortnight for singles, $804 a year.”

Moving forward, whether these changes affect you will depend on your personal circumstances, for example, whether the income or assets test determines your Age Pension entitlement.

If you have any questions regarding this article, please do not hesitate to contact us.