Maximising Retirement Benefits: 10 Strategies for Long-Term Growth

Written by Ben Waite & Dylan Sinclair

In the journey towards securing a comfortable retirement, maximising your superannuation benefits is crucial. Whether you are just starting your career or nearing retirement, adopting effective long-term strategies can significantly enhance your financial security in the future. Here are ten key strategies to consider:

1. Seek Professional Advice

Consulting with a financial adviser specialising in superannuation can provide invaluable insights and guidance tailored to your individual circumstances, goals and importantly your values. A recent 2023 study from Russell Investments shows that the value an adviser can contribute to your overall finance can be as high as 5.9% on an annual basis for Asset allocation, behavioural coaching and tax planning where the benefits are measurable (Jung, 2023). In other areas, benefits can be variable such as where trade-offs are possible or even priceless where an adviser expertise is effectively utilised.

2. Consolidation of Accounts

If you have multiple superannuation accounts, consider consolidating them into one fund. This easy win can help reduce fees and make it easier to manage your investments effectively. However, in doing so, it is important to consider any potential losses such as personal insurance held before consolidating your accounts.

3. Regular Contributions and Dollar Cost Averaging

Consistency is key. By making regular contributions to your superannuation fund, you can steadily grow your retirement savings over time. Even small contributions can make a substantial difference when compounded over the long term and reduce the chance of missing the best days within the market.

Superannuation is a mandated Dollar Cost Average strategy which in certain market conditions can produce superior result, as shown below, over infrequent lump sum investing.

Figure 1 Dollar Cost Averaging in Action (Robert, 2022).

In addition to your mandated contributions from your employer, also consider the following voluntary contributions below.

4. Salary Sacrifice

Consider sacrificing a portion of your pre-tax salary into your super fund. This not only reduces your taxable income but also boosts your retirement savings thanks to potential tax benefits. Consider an investor making $85,000 per annum. If they salary sacrifice $5,000 into superannuation, they pay $750 in superannuation tax rather than $1,725 of income tax. Over 10-30 years these extra payments into a tax-free superannuation pension after age 60 will quickly add up.

5. Utilise Government Incentives

Take advantage of government incentives such as after-tax co-contributions and spouse contributions to boost you and your spouse’s superannuation savings further.

6. Investment Diversification

Diversifying your superannuation investments across various asset classes can help manage risk and potentially increase returns. A well-balanced portfolio that includes stocks, bonds, property, and cash can provide stability and growth opportunities over the long term.

Consider Jane in the example below. With an advised portfolio of 80% growth assets against another portfolio of 70% growth assets could provide Jane with $22,000 in additional returns over a 10-year period.

Table 1 The disengaged super member (Russell Investment, 2023).

7. Regular Review, Adjustments, and Trade-offs

Keep your superannuation strategy under regular review. Make adjustments based on changes in your financial situation, goals, and market conditions. Flexibility and adaptability are key to long-term success as your financial complexity rises with age.

Figure 2 Generational Wealth Transfer (Fleischmann, 2022).

8. Transition to Retirement and Income Layering Strategies

As part of your regular review, and as you approach retirement age, explore strategies such as transition to retirement pensions. Whilst using salary sacrifice to save on income tax you can receive a 100% tax-free income stream after age 60 effectively keeping your required cash flow.

At this point in life, we would recommend considering longer-term decumulation tactics, such as investing in guaranteed lifetime annuities. These investments have the potential to notably enhance government benefits like the age pension.

Figure 3 Income layering (Challenger, 2022).

9. Incorporate Estate Planning

Ensure your superannuation is fully integrated into your estate planning. This will help to ensure your retirement savings are distributed according to your wishes but also, to reduce superannuation death benefit tax which could potentially be payable by adult beneficiaries. These little-known taxes can potentially reduce payouts by 17% on benefits.

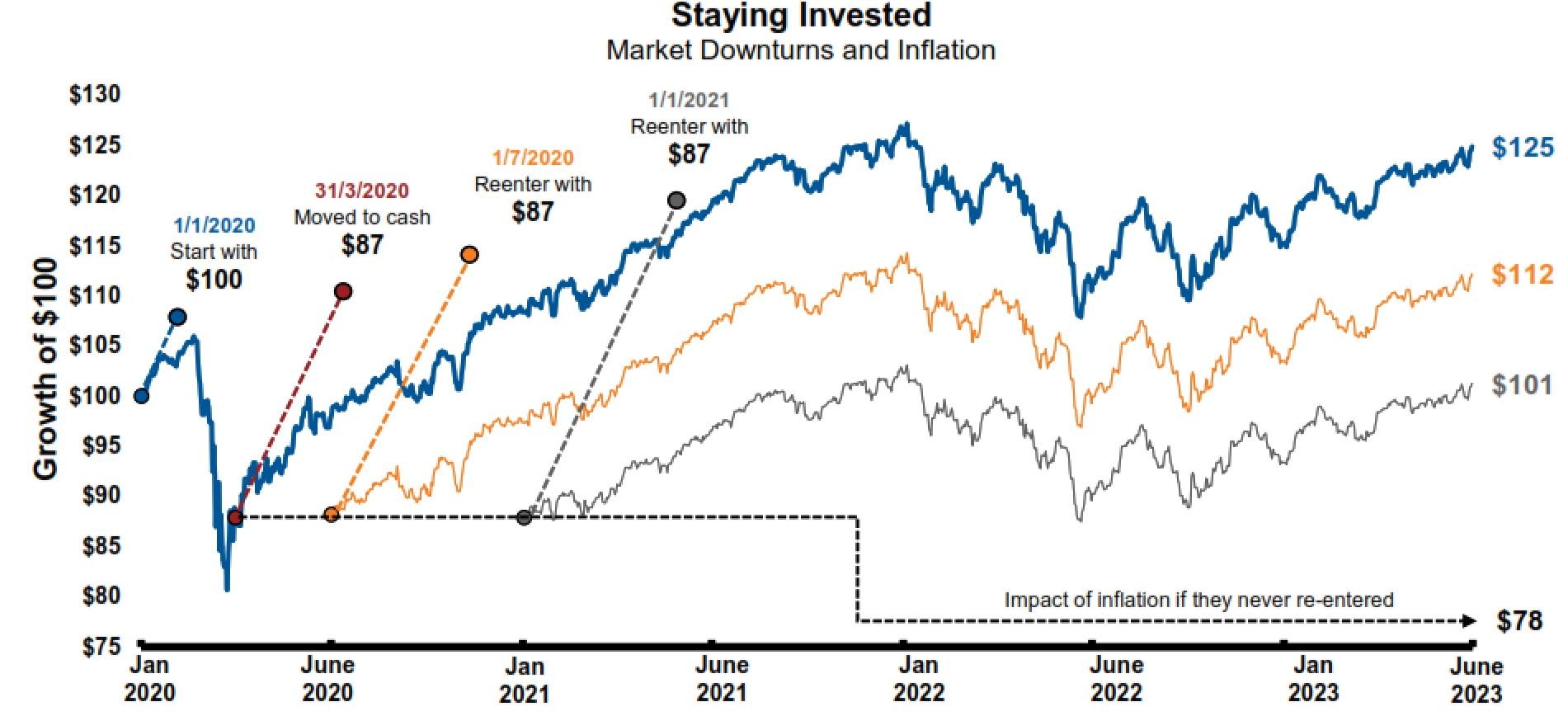

10. Maintain a Long-Term Perspective

Lastly, maintain a long-term perspective and avoid emotional decision-making. Remember, superannuation is a marathon, not a sprint. By staying focused on your long-term goals, you can ride out market fluctuations and maximise the growth potential of your investments.

Figure 4 Staying Invested: Market Downturns and Inflation (Russell Investment, 2023).

Consider Figure 4 above, where four investors who invested $100 in January 2020, all reacted differently to the COVID-19 downturn in March 2020 by selling and then re-entered the market at different times with $87.

Conclusion:

By adopting these strategies and staying committed to your retirement goals, you can maximise your superannuation benefits and secure a financially comfortable future. If you have any questions or need assistance in implementing these strategies, please do not hesitate to reach out to our team to help you to secure a successful financial future.